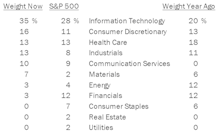

Select Industries

Multi-Year Holdings Key To Select Industries

The GS Scores help Leuthold Select Industries portfolio identify underappreciated themes that can turn into multi-year holdings. Managed Health Care has been a holding for over 13 years, while Semiconductor Equipment (seven years), and Homebuilding (six years) have also been long-term winning positions.

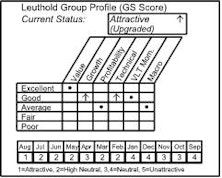

Financials Improve; Commodities Tumble

While it was a small jump, from #6 to #5 in the sector composite ranks, Financials might be seeing the start of overall improvement. Conversely, Materials and Energy continued to drop in the latest ratings, as fundamental measures deteriorated.

Select Industries Remains Active Within Sectors

The portfolio takes a very active approach within sectors, with almost half of its Consumer Discretionary weight allocated to Homebuilding, while completely avoiding Chemicals within the overweight Materials sector.

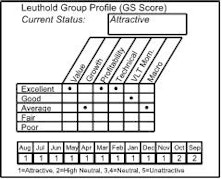

Group Selection Scores Remain In Gear

The Group Selection Scores have performed well in the first half of 2023, not an easy feat considering the abrupt style reversal that took place in January. Value and technical indicators are struggling, but the rest of the model is more than picking up the slack.

Select Industries Portfolio Shifts From Commodities To Growth

Exposure to commodities (and defense) has fallen rapidly within Select Industries. The primary beneficiaries of that reduction are growth-oriented groups.

Leuthold Select Industries Portfolio

As an all-cap strategy, Select Industries is currently targeting larger market-cap themes via our “Big” groups from Info Tech, Communication Services, and Health Care.

Leuthold Select Industries Portfolio

A combination of strength from Information Technology with weakness from Energy resulted in the two swapping places in our sector ranks this month.

Leuthold Select Industries Portfolio

Select Industries has overweight positions in Energy, Materials, Consumer Discretionary, and Industrials. The portfolio has no exposure to Consumer Staples, Real Estate, or Utilities.

Purchased Advertising: Global/Digital Prospects Appealing

Advertising has been in the top rankings of our Group Selection (GS) model for several months.

Oil & Gas Refining & Marketing: New Purchase

Amidst the Energy carnage, the Oil & Gas Refining & Marketing group is the exception, having returned over 7% YTD. Refiners are able to perform well in a variety of oil price scenarios—and tend to thrive in a falling crude oil price environment.

Homebuilding, More Than Just Curb Appeal?

While this Consumer Discretionary group has not experienced six-plus-years of market outperformance, we think it may be poised for a late-game bounce. An overall lack of housing options may be just what this industry needs to give it a long-awaited boost.

Asset Management & Custody Banks: New Purchase

The last time this group held an Attractive rating for an extended period of time was 2000. Based on the group’s extended underperformance, induced by repercussions of the global financial crisis, we think it may finally be poised for a turnaround.

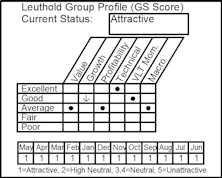

Bought Drug Retail = Consumer + Health Care In One Dose

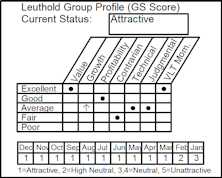

A new position in Drug Retail was added to the Select Industries Portfolio in April. The latest update to the Group Selection (GS) Score showed improvement in several factor categories which pushed the overall score back to Attractive.

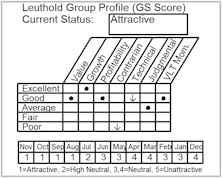

Purchased Reinsurance: GS Score Skyrockets

Reinsurance has rated Attractive for a little over one year, but the latest round of GS Scores sent this group’s score skyrocketing, and it now ranks fourth highest among all 115 industry groups. Select Industries Portfolio overall insurance industry group exposure now 8.1%.

Domestic & Global Long-Only Portfolios

Select Industries purchased Drug Retail, Reinsurance; Global Industries added to Homebuilding, Electronic Equipment

Domestic & Global Long-Only Portfolios

Both portfolios outperformed their respective benchmarks for the month and YTD.

A Good Year For Leuthold Industry Group Scores

Last year was a solid one for the Group Selection (GS) Score approach, with the Attractive list delivering a total return of +13.1%—more than 500 basis points above The Leuthold Group Universe average, which gained only +7.9%.

Domestic & Global Long-Only Portfolios

Select Industries gross composite gained 3.8% in November and is now up 16.7% YTD.

Domestic & Global Long-Only Portfolios

Select Industries slightly increased Department Stores & Health Care Facilities; Global Industries purchased Real Estate Management & Development and Road & Rail.

Domestic & Global Long-Only Portfolios’ Outperformance Persists

Select Industries bought Department Stores & Health Care Facilities; Global Industries Purchased Gas Utilities & Integrated Oil & Gas.

Domestic & Global Long-Only Portfolios Outperformed By 390 And 430 Bps, Respectively In First Half

Select Industries new purchases: Integrated Oil, Semiconductors, Water Utilities; Global Industries added to Energy, Technology, and Financials.

Domestic & Global Long-Only Portfolios Beat Benchmarks In May; Both Outperforming YTD

Select Industries sold Systems Software; Global Industries bought first Energy group in almost 12 months (Oil & Gas Exploration).

Long-Only Portfolios Lag In April, But Ahead YTD

Select Industries bought Oil & Gas Refiners; Global Industries bought Emerging Diversified Banks.

Long Only Portfolios Beating Benchmarks

Select Industries had no group deactivations again this month, but we trimmed a few groups and added Commodity Chemicals. All group holdings currently rate Attractive. Global Industries had no changes. Emerging Electric Utilities, which we added last month, was the second best performing group in March.

Long Only Portfolios Beating Benchmarks

Select Industries had no group deactivations this month, and we made no significant changes to our group weights. All group holdings currently rate Attractive. Global Industries eliminated our longest tenured group, Regional Banks, which we held for two years. We added Emerging Electric Utilities, which is our first EM oriented group since June 2013.

Long Only Portfolios Down For The Month But Beat Benchmarks

Select Industries had no group deactivations, trimmed Consumer Finance and purchased Systems Software, further boosting our Tech holdings. Global Industries had no group deactivations, trimmed our Reinsurance and boosted exposure to Health Care, Industrials, and Info Tech groups.

Long Only Portfolios Finish 2013 Strong

Select Industries deactivated Specialized Finance. Global Industries deactivated Food & Staples Retail and Road & Rail and purchased Managed Health Care.

Long Only Portfolios See Low Turnover

Select Industries added exposure to Health Care Distributors and Multi-Line Insurance. Global Industries deactivated Media and purchased Health Care Services.

Long Only Portfolios See Low Turnover

The Select Industries sold Railroads and bought Tech Distributors. For the second month in a row Global Industries saw little turnover and no equity group deactivations.

Aerospace & Defense Purchased

With a wide range of market cap choices, an excellent technical profile, and less dependence on federal spending than you might think, this group has compelling stories of future profitability and growth.

Select Industries: Adding Aerospace & Defense Group

Aerospace & Defense was added to the portfolio this month.

Health Care Distributors Purchased In Select Industries

Excellent scores in three of six model categories, plus it offers plenty of market cap and low beta relative to other Health Care groups. We think it will benefit from broad, long-term industry trends.

Electronic Manufacturing Services Purchased In Select Industries

Attractive valuations, improving growth and technical strength are the key drivers. The group offers an opportunity to participate primarily in the overall growth of computing devices.

Select Industries: Adding Insurance To Portfolio

Multi-Line Insurance was added to the portfolio. While several insurance groups currently rate Attractive, we like the diversified nature of the Multi-Line group.

Select Industries: Airlines And Rails Remain Largest Group Holdings

Group Deactivations, New Groups and best performing groups in May.

Still Flying With Airlines

While their scores remain strong, the underlying factor strength has shifted as these stocks have soared. Our quantitative disciplines and a compelling underlying fundamental story are keeping us in flight.

Specialized Finance Purchased In Select Industries

Group’s technical and value profile drive Attractive rating, and its diverse mix of companies are poised to benefit from the current macro environment.

Where To Buy In The Changing Landscape Of Advertising

Select Industries makes an Advertising buy, looking for the large integrated agencies to make their best pitch.

Select Industries Takes Flight With The Airlines

This group has been Attractive since March, and currently ranks fourth in our Group Scoring model. We think an improving fundamental story, coupled with a strong GS Score, is emerging from this ravaged industry.

New Positions In Select Industries Portfolio

Two groups were purchased in the Select Industries portfolio in late October: Health Care Services and Wireless Telecommunication Services.