Short Interest

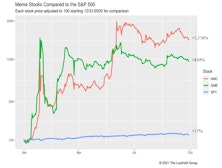

Where's The "Meme" Reversion?

The recent bout of market turbulence has taken a little shine off of the two most famous meme stocks. Still, the elevated levels at which both AMC and GameStop trade can be described as nothing short of spectacular.

Putting More And More On Margin

In one year, the bull market has persuaded investors to do something they were reluctant to do near the end of an almost eleven-year bull: Lever Up. Year-over-year growth in Margin Debt reached 49% in February and should catapult far above the “conventional” 50% danger threshold with March’s results.

Short Performance And Short Interest Both Revert

The Reddit-driven January performance of heavily-shorted stocks reversed in February, but not nearly enough to reverse all the previous gains.

Short Interest Is A Valuable Tool

The Short Interest Ratio performs well as a factor; on both the long and short sides.

Sector Short Interest Ratios Reviewed

We look at Short Interest Ratios within the S&P 1500 sectors for clues on future market prospects. The Materials sector is one where it has paid to monitor what short sellers are doing (or not doing).

EM Sentiment Readings Reach Extremes

A few measures are suggesting that investor sentiment towards EM has reached a low ebb.

A Milestone You Might Have Missed

The fifth anniversary of the bull market was met with fanfare, but the launch of the Large Cap leadership cycle in April 2011 is receiving no attention whatsoever.

Technology’s Prospects For Long Term Leadership Looking Good

Nine Technology groups are in the top quintile of our group model, and the sector has strengthened on a relative basis after twice “testing” a trendline that dates back to the early 2000’s tech wreck. There’s reason to believe the new uptrend has longer-term legs.

Short Selling: From Un-American To All-American

It doesn’t seem too long ago when short sellers were vilified for bringing down viable public companies, and the appropriate punishment for short selling was deemed to be a public caning.

No "Heads Up" From Short Interest....

The Leuthold Group maintains three short interest models. All three issued timely BUY signals on the market near the summer 2006 lows, but none of these three models provided any hint of the market weakness that recently unfolded in July and August.

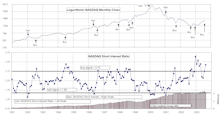

A Long-Term Look At Short Interest

To supplement our traditional short interest models, we have developed a long-term, normalized measure of short interest that is intended to “self-adapt” to the institutional changes unfolding in short selling.

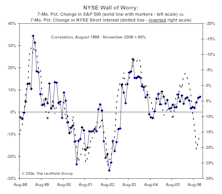

Some Erosion - But Not A Collapse - In The Wall Of Worry

The surprising restraint in investor enthusiasm has been a key pillar behind our bullish case for the stock market.

Sentiment Still Supportive

Sentiment measures still show pessimism among investors. Doug Ramsey looks at the current sentiment gauges for the market and also examines the current sentiment readings for 24 broad industries groups.

View From The North Country

Despite the stronger stock market, there continues to be a healthy degree of bearish sentiment prevalent in today’s market.

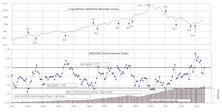

NASDAQ & NYSE Short Interest

Ratios decline as volumes increase.

NASDAQ & NYSE Short Interest

New NASDAQ buy signal as volume declines. NYSE short interest ratio increases again as volume and short interest both decline.

NASDAQ & NYSE Short Interest

Both the NYSE and NASDAQ short interest ratios saw increases in July.

NASDAQ & NYSE Short Interest

While the NASDAQ short interest ratio continued to decline, the NYSE ratio increased in June.

NASDAQ & NYSE Short Interest

Both indicators drop to neutral in May.

NASDAQ & NYSE Short Interest

Both the NASDAQ and NYSE short interest ratios increased in April.

NASDAQ & NYSE Short Interest

Both ratios still bullish.

NASDAQ & NYSE Short Interest

Both ratios reconfirming a buy signal.

NASDAQ & NYSE Short Interest

NASDAQ ratio declines on increased volume. A new style this month gives the NYSE ratio more timely signals.

Short Interest....NASDAQ Hits Record High Ratio, As December Volume Plummets

This month’s ratio increased to 3.54 from 2.72, marking the highest ratio ever recorded.

Short Interest...Still High Despite October And November Performance

While short interest has retreated slightly, it still remains quite high, indicating there may be more upside pressure from short covering.

Short Interest...Short Interest Still High Despite October Performance

Short interest was actually up 1.1%, but a 16% surge in average daily volume accounted for the short interest ratio decline.

Short Interest...Both Ratios In Bullish Territory

This month’s NASDAQ ratio remains in bullish territory after last month’s buy signal.

Short Interest...First NASDAQ Buy Signal In A Year

NASDAQ Short Interest Ratio posts first buy signal in a year as volume declines in August.

Short Interest...Record High Shorts, But Both Ratios Decline With Market Volume Jump

In July, average daily volume surged significantly enough to decrease the short interest ratio, despite record levels of short selling.

NASDAQ & NYSE Short Interest

NASDAQ record high short selling. NYSE moving to new highs.

NASDAQ & NYSE Short Interest

NASDAQ ratio was flat for May while the NYSE's showed a very strong positive.

NASDAQ Short Interest…..Flat For April

Even though the NASDAQ is again in decline, a new buy signal is not imminent here.

NASDAQ Short Interest

NASDAQ short interest ratio up in March.

NASDAQ Short Interest Ratio: A Useful Tool

Slight decrease this month, but still riding the August buy signal.

NASDAQ Short Interest Ratio: A Useful Tool

The NASDAQ short interest ratio decreased in January.

NASDAQ Short Interest Ratio: A Useful Tool

We think we have found a “reliable” indicator with a proven track record.