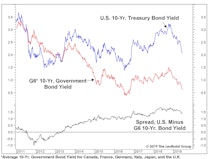

Spreads

Revisiting The 1966 Forecast Failure

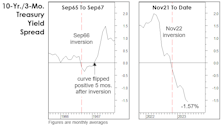

Developments over the last four months leave us even more skeptical that the November yield-curve inversion will join 1966 as a “false positive.” The number one reason being the subsequent shift in the yield curve itself.

The Growth Style’s Twin Peaks

The strong market rebound in the second quarter lifted the relative return of Growth vs. Value to an all-time high by the end of June. Chart 1 reveals that the cumulative S&P 500 Growth / Value return spread hit a new record last month, surpassing the previous high reached at the end of the Tech bubble in June 2000.

Limbo Rock!

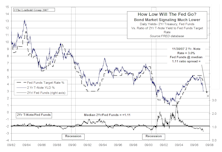

As global rates have taken a precipitous dive the last few months, it’s been hard not to hum “Limbo Rock.” And just like Chubby Checker, we’ve been asking our screens “How low can you go?” on a daily basis.

Can Smart Analysts Generate Smart Beta?

We assess the effectiveness of using Wall Street analyst opinions as factors in a quantitative stock selection model. Watch for the full report coming next week.

Narrow Performance Divergence Among EM May Not Last

We’ve previously noted the narrowing performance divergence between top- and bottom-performing Emerging Market (EM) countries in recent years.

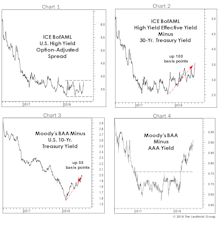

Trouble Is “Spreading”

Junk bond option-adjusted spreads (OAS) have remained relatively tight throughout the stock market pullback and recovery (Chart 1), assuring some bulls that the action is nothing more sinister than a “healthy and overdue” correction.

An Alarming 2008 Analogy?

While breadth and leadership accompanying the upswing off February lows have been impressive, the most outstanding feature of this advance might be the confirmation provided by high yield bonds.

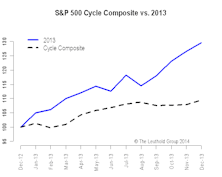

2014 Time Cycle—Lower Your Expectations & Be Patient

It’s time to update our time cycle composites, and what they say for equities in the U.S., U.K., Germany and Japan and long-term interest rates and credit spreads in the U.S.

Believe It Or Not, New Highs

Steps are falling into place for the U.S. market to climb another 15-20% into 2012.

How Low Will The Fed Go? Bond Market May Be Offering Some Clues

In trying to assess how far the Fed may ultimately be forced to cut rates, the price action in short term Treasuries and historical yield relationships may offer some clues.

Rising High Yield Spreads....Implications For An Agnostic Stock Market

Link between Junk bonds and stock market seems to be indicating that stock investors are ignoring factors pushing Junk bond yields higher.

_0.jpg?fit=fillmax&w=222&bg=FFFFFF)