Stock Market

If Inflation Has Peaked, Thank The Stock Market—Not The Fed

High inflation continues to dominate the headlines, but it is only one piece of the “weight of the evidence” that’s stacked against the stock market. Still, in ironic fashion, stock-market action itself suggests that inflation is set to peak.

The Stock Market IS A “Fundamental”

The impact of U.S. stock-market “hegemony” extends far beyond currency markets. We believe the mania has progressed to the point where the stock market itself will shape the intermediate-term and even long-term fortunes of the U.S. economy more than it ever has before.

Are Stocks And The Economy Disconnected?

The consensus among market pundits is that a U.S. recession will be averted and, as a consequence, domestic stocks remain the best game in town.

Slowdown Or Recession? Confidence Is Key

The pattern of sharp sell-offs followed by equally sharp rallies continued in June. Most risky assets recouped nearly all the losses suffered in May, and then some.

Stock Market Valuation Check

The Major Trend Index has bounced back into positive territory, and we expect an already-expensive U.S. market to make even higher highs later this year and into early 2018. But we are keeping an eye on the Intrinsic Value work to assess the potential losses that might occur when cyclical conditions eventually turn hostile—possibly in later 2018 or in 2019.

Was That All There Was To It?

As quantitative investors, the disciplines of the numbers trump stories—even our own. But we’re struck that the stories depicted by our Major Trend Index and other market tools over the past two years are entirely logical and sequential. Unfortunately these stories rhyme with those of past market cycles.

Navigating The First Rate Hike

Our current view is the lift-off will be December or later. Assuming inflation will pick up and the Fed hikes the rate by the end of 2015, stocks will perform relatively well, with international stocks a better bet than U.S. stocks.

The Economy And Earnings

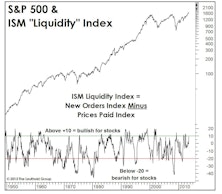

The YTD surge of 19% in the S&P 500 should ensure a stronger second half economy, and the big five-point jump in the latest Purchasing Managers Survey (ISM) might be the first evidence of this.

Ringing In The New Year On A Wide Range Of Topics

Did we just get a Technical “all clear” sign? Is the trading day getting you down? What about corporate earnings, or sovereign debt and the stock market?

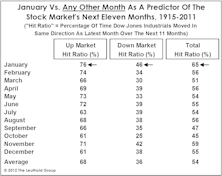

Up Market In January = Up Year??

As January goes, so goes the year. 2012 looks like it could well be an up year for stocks based on the January barometer. Market cycle chart from 1958 also says 2012 will be the “time to buy.”

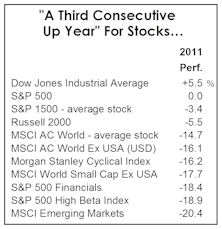

“Another” Year Of Gains?

U.S. equity investors were disappointed in 2011, but we’d point out they fared better than investors in 45 of 48 other countries tracked by MSCI.

Iraq Withdrawal? “No-Win” Military Conflicts’ Impact On the Stock Market

Is market rallying in anticipation of conflict resolution in Iraq? Bush will be under increasing pressure to resolve things before the 2008 Presidential election. We look at the Korean conflict and Vietnam war for clues about how this possible resolution in Iraq may play out in stock market.

Inflation Impact On The Stock Market

CPI expected to decline in 2006 and historically a decelerating CPI is a significant stock market positive, producing above average returns. Stage could be setting for a market rally in 2006 as inflation pressures wane.

View From The North Country

Steve Leuthold lays out both the bullish and bearish stock market cases.

View From The North Country

A recap of the year so far, and our outlook for the second half of 2005.

View From The North Country

A special Kate Welling interview with Steve Leuthold. Discussion runs the gambit from Leuthold’s current outlook for the stock/bond markets, to groups he favors, to liquidity concerns, and hedge funds.

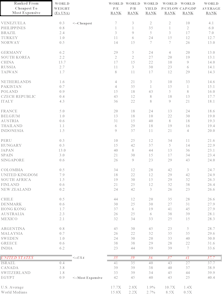

U.S. Market Remains Relatively Overvalued Compared To Rest Of World

U.S. market ranks as fifth most expensive market based on comparisons to 44 countries from around the world.

Keep In Front Of The Economic Curve

Stock market is a leading economic indicator, and typically turns down before the economy turns down. On average, 40% of the stock market decline occurs before the recession begins.

View From The North Country

Steve's Half Time Report: A recap of the year so far, and our outlook for the second half of 2004.

Bull Market: Part II

Bull Market Part II. Early 2004 correction seems over, rally appears to be developing

View From The North Country

This month’s “View From The North Country” presents data showing periods where interest rates (both long T-bonds and 90 day T-bills) rose and stocks also rose. It can happen!

View From The North Country

I cannot recall another time when professional stock market opinion was so universally bullish regarding the coming year.

Deflation: Not Likely, But, “What If?”

We think deflation fears are overblown, but, it isn’t necessarily bad for stock performance.

Can Bond Market Returns Match Future Stock Returns?

It will be tough for bonds to keep up with stocks over the next several years even though stock and bond returns are neck and neck over the past twenty years.

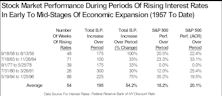

Rising Interest Rates Don't Always Mean A Falling Stock Market

A look at market performance over five different rising interest rate periods. Results are somewhat surprising.

View From The North Country

Leuthold’s New Year Predictions for 2002 and a review of last year’s predictions.

The Economic Time Clock…..Recessions And The Stock Market

Recession means it is time to buy stocks. Knowing to buy stocks half way through a recession is easy. The hard part is, when the recession started, and when it might end.

View From The North Country

Navigating safely through the current, turbulent market environment requires more experience, knowledge and training.

A Weak Economy With A Strong Stock Market?

Earnings are declining and economy has slowed. Just why are we buying stocks?

View From The North Country

Thermal pollution time again: Steve’s New Year predictions for the economy and his market outlook, including a look back at last year’s forecasts.

View From The North Country

Workers’ stock market purchasing power at all time low. Also, a book out of the past, has an eerie ring to it.

View From the North Country

Stock market still considered lead economic indicator? Maybe not, considering the last three years, the stock market has been driven by Main Street. Changing role of portfolio managers: risk management function reduced to minimum if it even exists at all.

Putting It In Perspective...A Look At Equity Performance Over Last 15 Years

Last 15 years have been the best 15 year stock performance period ever recorded. Many of today's investors expect this to be the norm. Next 3, 5, 10, or 15 year time periods cannot be expected to rival current returns.

The Stock Market and the Economy: Lead and Lag Relationships

In past issues, we have postulated that the next major stock market decline would not precede an economic downturn as it typically has in the past. Rather, the relationship would be coincidental, with the stock market and the economy turning down at about the same time.

View from the North Country

Thermal pollution time…Steve Leuthold’s 1996 views (and 1995 reviews) on stocks, interest rates, economy, dollar, deficit, earnings, alternative investment areas and, yes, the Super Bowl.

View From the North Country

Should we just own stocks and forget about asset allocation? After all stocks have been the best performing asset class over the last 70 years.

View From the North Country

Economic growth and stock market performance don’t go hand in hand - the stock market looks ahead. Don’t be surprised by more wage irrflation. The AdvantHedge short selling program is updated and explained because readers have expressed a growing interest (maybe it’s the market).

Polling the Pros in New York/Setember!

NY pros expect a trading range market over the next three months (no surprise). On a one year horizon, 53% of those polled were bullish to some degree (this was a surprise).

A Strong Economy and a Weak Stock Market?

The stock market often underperforms when the economy is strong and earnings are surging. It performs best when real GDP is negative and earnings are declining.

The U.S. Stock Market: The Next Ten Years (Continued)

Does historical data suggest that a big performance decade is followed by a poor relative performance decade? Or, does a big performance decade beget an extended period of above average performance?

.jpg?fit=fillmax&w=222&bg=FFFFFF)