Stock/Bond Relationship

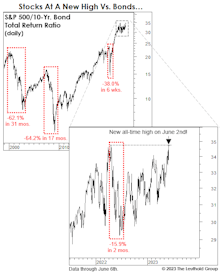

Stocks Versus “Safe Havens”

While we aren’t clamoring to add long-term Treasuries in tactical accounts, we believe that the past 18-months’ action has left them more attractive versus stocks than during most of the last 15 years. However, compared to gold, the S&P 500 still trails on a total return basis measured back to Y2K.

Smarter Than The Bond Market?

The half-percentage-point drop in the 10-year Treasury yield, since mid-March, has investors worried about “what the bond market might know” that the stock market doesn’t. Maybe it’s time to stop lionizing the bond market’s prescience and give the stock market its due.

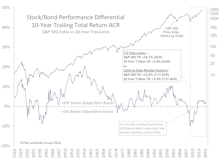

The State Of The Stock/Bond Relationship

The latest action in rates is not what would be expected during a strong stock-market rally off a bear market low, but the constantly changing nature of the stock/bond relationship should not come as a big surprise. We propose a more refined four-state definition of the stock/bond relationship.

A Stock/Bond Relationship Revisited

Herein we further explore this month’s theme of “point-in-time relationships” and subsequent market returns. We review and update a study we initially conducted and published in June 2009.

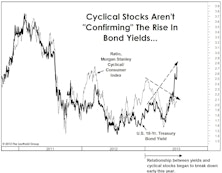

Bonds & Cyclical Stocks “Decoupling”?

The relationship between U.S. Treasury bond yields and the relative performance of cyclical stocks versus their defensive consumer counterparts appears to be changing.

A Monetary Indicator That Still Works

The Dow Jones Corporate Bond Index has worked in eight of the last nine decades. The credit information in corporate bond prices provides valuable input for investors.

Client Questions

Here again are some of the client queries we have had over the last month or so.