Treasury Bonds

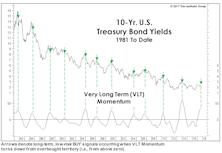

Bond Yields: Cyclical Pressures Vs. Positioning

Even after watershed events COVID-19 and MMT, some things never change.

Next year will begin like almost every one of the past dozen years, with economists and strategists expecting bond yields to rise.

Unlike most of those years, though, there are several measures of “cyclical pressures” that would seem to give them a good chance of being right. The best-known among these might be the “Copper/Gold Ratio,” popularized by DoubleLine’s Jeffrey Gundlach, which suggests 10-Yr. Treasury yields should be around double their current level (Chart 1).

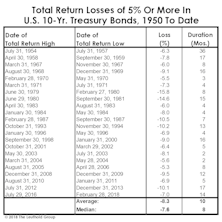

“Unlevered” Treasuries Aren’t A Bubble

It’s been popular to argue that U.S. government bonds are a bubble while U.S. equities are not. But even if we agreed, the potential cyclical total return losses in Treasury bonds are a fraction of those likely to occur in an equity bear market.

The Bear Market No One Discusses

Yields on 10-year Treasury bonds have still not breached the 3.00% level that many believe will stick the proverbial “fork” in the secular bond bull market that began in 1981. That could well in happen in the next few weeks, but we believe it’s important to step away from the daily fray and reflect upon the damage that’s already been done.

Four Divergences—A Steepening Correction

While we still believe flattening is the more likely scenario over the medium term, we do feel the recent flattening move is a bit overdone and there are several divergences that suggest a short-term steepening correction is in store.

A Mysterious Bond BUY Signal…

Sometimes we feel compelled to report findings that conflict with our outlook. And then there are the even rarer times we actually do it.

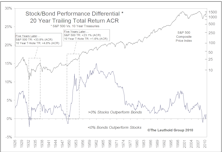

Hare Passes Tortoise

Last week we overlooked a key milestone among the daily parade of new stock market highs: The Stock/Bond Total Return Ratio finally exceeded its cyclical high from the summer of 2007. Since July 13, 2007, the S&P 500 has generated a cumulative total return of +73.5%, just ahead of the U.S. 10-Year Treasury Bond total return of +70.0%. These work out to annualized returns of around 6.0%.

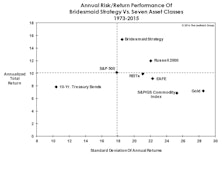

Bridesmaid Asset Strategy

Liquidity “consuming” strategies like price momentum are generally considered to be more volatile than liquidity “providing” approaches like value investing.

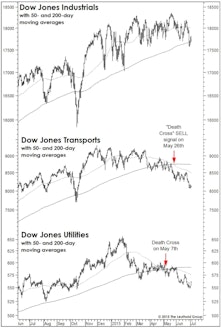

A BUY Signal That Says SELL?

Last month we discussed the negative market implications of May’s “Death Cross” signals in the Dow Transports and Dow Utilities.

What To Do With Broken Models?

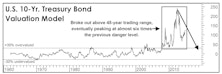

With the quantitative horsepower now available at the fingertips of even the most technophobic portfolio manager, there’s little tolerance for any model that finds itself out of sync. But “broken” models (and especially value-based ones) have an eerie way of reasserting their relevance just after they’ve been finally tossed to the trash heap.

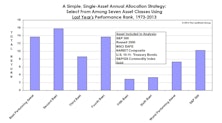

Buy The Bridesmaid, Not The One Looking To Rebound

The investment leadership of a given year has historically had better-than-even odds of outperforming in the following year at both the asset class and equity sector levels.

The Math Doesn’t Work For Long-Term Treasuries

The recent upside breakout in the U.S. 10-year yield was successful, and it appears interest rates will remain in the new higher range for now. But what are the short-term implications of higher U.S. Treasury rates on asset allocation decisions?

The Upside Breakout

We still think interest rates are likely to be range-bound, but the range will likely shift higher to the 185-240 bps area if the current breakout is successful.

The State Of Interest Rates

We think interest rates will stay low for an extended period of time, so the key question is, when will rates start rising?

Chasing Income That Barely Exists

Those adopting LDI today are doing so at the least opportune time in more than 60 years.

The Reach For Yield… And Its Consequences

Investor infatuation with portfolio income is higher than ever, just as there is less of it available than at any time in history.

Not So Calm In The Bond Market

The failed break-out to the upside on the U.S. 10-year yield fits our expectation of a range-bound but higher-volatility environment.

The Bubble In Bonds...

Yes, we consider U.S. Treasury securities a bubble across the entire yield spectrum, and the situation has probably now moved into “extra innings” (think 10th or 11th) thanks to the flight to (perceived) quality triggered by the European debt crisis.

Bonds: Beginning Of The End?

Today’s bond market is reminiscent of the stock market in April 2000—when the first cracks in tech and telecom had appeared.

Start Of A New Bond Bear Market Or Not, There Is No Need To Rush

Whether it’s the start of a new bond bear market or not, there’s no need to rush... and why shorting bonds may not be the best idea, even during a bond bear market.

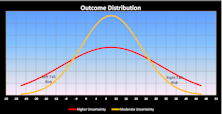

Looking Deeper Into The Tails Of Distribution

Leuthold’s Eric Weigel examines both positive and negative tail risk among asset classes over two time periods… the recent volatile era versus a preceding, not-as-volatile time period.

Risk Premium for Stocks Making a Comeback…

Andy Engel revisits our Stock/Bond Performance Differential study which examines rolling stock/bond spreads over various time periods and subsequent asset class returns. It appears that trends are finally reverting slowly toward the norm.

Lost Confidence In Washington….. But Not U.S. Treasuries

The new deal reached by Congress has little substance and no impact at all until 2014 or beyond. More “kick the can down the road.” Long term debt/deficit issues remain unsolved.

Losing Confidence In Washington But Not U.S. Treasuries, At Least Not Yet

The inability of our politicians to recognize and resolve short and long term debt/deficit issues has caused many of us to lose even more confidence in Washington.

It’s The Economy, Stupid

U.S. likely averted worst-case scenario of default, but credit rating downgrade is still likely. Main impact of downgrade is not the increase in interest rates itself, but rather the liquidity risk in all markets that involve treasury securities as collateral.

Longer Term Concerns About U.S. Debt And Deficit

$4.8 trillion of the additional $9 trillion in debt that Uncle Sam is expected to incur over the next decade is interest obligation.

Another Walk On The Short Side

In mid-May, we re-initiated a short position across all three tactical funds in U.S. Treasury bonds.

The Bond Bubble Is Beginning To Deflate… Is This Cheap Money Era Ending?

Long term interest rates could continue rising, as inflation expectations increase and investors demand higher yields.

The Bond Bubble Is Beginning To Deflate… Is This Cheap Money Era Ending?

Bond bubble deflating, as investors demand higher yields to compensate for rising inflation and mountain of debt.

The Bond Bubble Is Beginning To Deflate… Is The Cheap Money Era Ending?

The bond bubble is deflating, as investors demand higher yields to compensate for expected rising inflation and the U.S. mountain of debt.

Risk Premium For Stocks Making A Comeback

History appears to be repeating itself as the risk premium for stocks is making a comeback. Ten-year Treasuries are now the riskier asset class compared to equities.

Slowly Righting The Ship Of Risk And Reward

Stock/bond Risk-reward relationship beginning to return to normal. Back in Q1 2009, performance differential between S&P 500 and 10 year T-bonds was at generational lows. In prior periods of bond superiority, stocks ultimately came soaring back. Expect to see stocks do much better over next 5 years.

Lookback Blues… Still Depressing Long Term Equity Performance

It’s easy to see why equity investors are so down when looking at updates of the long term stock market performance. It’s even more depressing when long term equity returns are compared to bond returns.

Testing The Treasury Bond Yield

The longer term data does suggest that at current interest rate levels, investors can expect sub-par returns over the next 1, 3, and five year timeframes— and we use the term “sub-par” quite literally.

Raising Longer Maturity U.S. Treasury Twelve Month Interest Rate Targets

Jim Floyd is boosting his 12 month interest rate targets by about 50 basis points across the board. The economy is expected to be showing signs of recovery by year end 2009, and the credit markets are thawing.

Bond Sentiment: Window Closing For Bulls?

Since economic fundamentals are providing little help lately, an understanding of bond sentiment has become especially helpful.

Expectations For Bonds Still Too High

Despite the December correction, our 10-week Hines ratio (a modified put/call ratio) continues to show rampant speculation in T-bond futures call options, suggesting speculators are still betting on declining yields.

2007 Outlook: CPI Tame First Half And Economy Chugging Ahead Slowly

Expect economic recovery to pick up a little steam in early 2007, before slowing down in the second half. A 2008 recession is a possibility.

View From The North Country

Does consumer confidence offers any insight into future spending patterns? Also, the case for shorting T-Bonds.

Bond Market Summary

Recent 25 basis point bump-up by Fed will not be the last. More tightening seems likely but T-bonds now look to be in the high end of a buying zone.

Bond Market Summary

Big Rise in Treasury yields has resulted in improved risk/reward profile for T-bonds.

.jpg?fit=fillmax&w=222&bg=FFFFFF)

.jpg?fit=fillmax&w=222&bg=FFFFFF)