Treasury

What The Curve Does And Doesn’t Tell Us

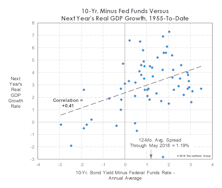

The gap between the 10-year Treasury yield and the federal funds rate has narrowed sharply in the last year but remains a long way (~110 basis points) from inverting.

A “Busted” Bond BUY Signal

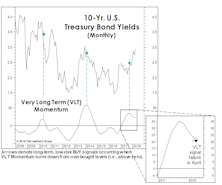

Last October our VLT algorithm recorded a bond BUY signal—one that we said, at the time, conflicted with our outlook.

A Near-Perfect Model You Should Ignore

We somehow missed this signal in January, perhaps because we were pre-occupied with so many other signs of “climate change.”

1987 Parallels (Part 2)

At the risk of yelling “fire” in a crowded theater, we present a few parallels between recent action and the year leading up to the October 1987 crash.

Will Rates Kill The Low Vol Mania?

While there are many parallels between recent action and that of 1999-2000, stock market leadership is not one of them.

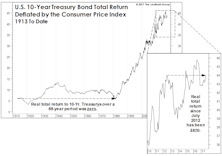

Spoiler Alert! The Bond Bear Is Already Here...

Bond investors residing in the Lower For Longer© camp no doubt feel vindicated by the summer rally that’s taken yields on 10-year Treasury bonds to as low as 2.06% in early September.