Volatility

Small Cap Quality Check

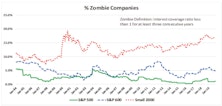

December’s Of Special Interest provided a recap of our Asset Allocation team’s view of small cap equities, suggesting that small caps had underperformed and reached a valuation discount that made them an interesting contrarian value proposition. Several clients responded with follow-up questions, wondering if the discount valuation of small caps was offset by their typically weaker business models.

Can Equity Investors Eat Their Cake And Have It Too?

Investor sentiment seems to be unusually conflicted these days. There are worries aplenty, including numerous political skirmishes of consequence around the world, a slowing global economy, and lofty U.S. equity valuations. On the other hand, fiscal stimulus is high for this stage in an economic cycle and the Fed is easing monetary policy, two policy drivers it rarely pays to bet against.

Low Vol For All Seasons?

The early August setback took the S&P 500 below its late-January 2018 high—and the time when we first trimmed net equity exposure in Leuthold tactical funds from a nearly fully-invested posture.

Portfolio Positioning: Deciding Not To Decide

One portfolio strategy that attracts our interest is a barbell between Growth or Quality on the bullish side, paired with a Low or Minimum Volatility sleeve for the bearish side. This approach deals with today’s uncertainties by essentially “deciding not to decide.”

Beta & Volatility On The Move

We explore these factors’ behaviors from the stance of our proprietary equity group universe and present industry ideas—across sectors—that fit each of these investment viewpoints. The intent is to offer new investment ideas from a different analysis perspective.

Earnings Releases Cause Surge In Price Volatility

Three years ago, we did a series of studies looking at price reactions to corporate earnings releases (ER) and we found that, since 2007, price movement has become more dramatic on ER days.

Defensive Equity Styles: The Sultan Of Swat And The Splendid Splinter

After performing amazingly well in the record-setting bull market run since 2009, defensive equities are once again drawing attention for their traditional role as hedges against a continuation of recent market declines.

Leverage Factor: A Boost For High Quality Stocks?

A review of Quality factors, as well as the lower valuations of High Quality stocks, supports the current High Quality cycle amid rising market volatility. The Leverage factor may provide particularly strong backing for High Quality stocks.

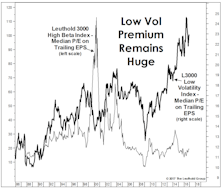

Will Rates Kill The Low Vol Mania?

While there are many parallels between recent action and that of 1999-2000, stock market leadership is not one of them.

Are Higher Rates Set To Hit The Low Vol Stocks?

The Low Volatility theme has been the darling of this bull market, benefiting from years of skepticism surrounding the economic expansion and the related lack of competition from fixed income instruments...

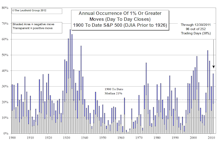

2017 Vs. Other Years Of Market Calm

Record lows in implied volatility (VIX) have been analyzed ad infinitum throughout 2017, but the readings shouldn’t come as any surprise.

Someday, Fear Won’t Be Bullish

Does this year’s incredibly low stock market volatility mean the end is near? History is inconclusive.

Too Calm For Comfort?

Is stock market volatility so low that it’s a bad thing? For volatility sellers, the answer is an unequivocal yes. But for stock market investors, the answer isn’t so clear.

What’s Ailing Small Caps?

While the Russell 2000 loss during the 2015-16 correction was almost double that of the S&P 500, the decline did not fully erase the P/E premium Small Caps have enjoyed since the middle of last decade. The premium might need to be entirely erased before a multi-year Small Cap leadership cycle can begin.

Tilt Toward Beta

Stock market valuations certainly show no lack of investor confidence: each of our “Big Six” valuation measures now resides in either its ninth or tenth historical decile.

In The Volatility “Sweet Spot”

Market anxieties have inched up over the last several weeks despite the proximity of all major indexes to cycle highs. The MTI’s Attitudinal category has improved by about 70 points in the past few weeks, and we sense more worry than usual over potential for turmoil in the seasonally-weak months of September and October.

Momentum Trouble

Momentum reversed in February, primarily due to rallying Materials stocks. Value and Profitability both performed well.

Paying Up For Protection

While most factors performed well during the January sell-off, those providing stability worked the best. Low Volatility, Profitability, and Size were notable outperformers.

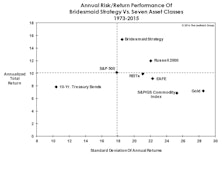

Bridesmaid Asset Strategy

Liquidity “consuming” strategies like price momentum are generally considered to be more volatile than liquidity “providing” approaches like value investing.

Quantitative Factor Performance: What Is Working?

For the third consecutive year (thus far), quantitative factors worked best within the Materials sector. Energy also saw success as the decline in oil hurt the same stocks as in 2014. Factors were least effective in Health Care and Telecom.

Stocks Vs. The Dollar—More Complicated Than You Think

The recent strength in the dollar coincided with a spike in volatility and weakness in risky assets, but the relationship over the last couple years has been tenuous at best.

GS Scores Hold Up During Volatility

The Attractive range of the Group Selection (GS) Scores outperformed the Unattractive range in the volatile September market.

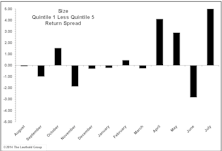

Market Value Impacting Returns

Small Cap stocks significantly underperformed Large Cap stocks since late March.

The Volatility “Sweet Spot”

Daily stock market volatility has levitated at levels a bit higher than the VIX—in a zone that has historically been “optimal” for short-term performance.

Sell in May

This does not only apply to stocks, it applies to just about all risky assets.

Correlations Staying Steady

The decrease in correlations has been helpful for investors, but the lack of volatility in the measure has arguably been more important.

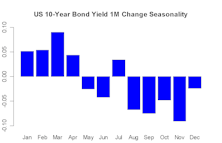

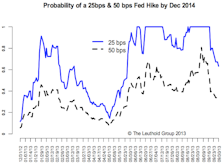

10-Year: Year-End Target Still 250 BPS, Interim Volatility Expected

We don’t think the numbers between now and the Fed’s December meeting will be strong enough to convince it to start tapering this year. No taper until 2014, in our opinion.

No Taper—More Downside Likely On The 10-Year & Higher Volatility Ahead

A look at prior debt ceiling debates and patterns around resolution dates gives no surprises: markets are weaker in the two weeks before but stronger in the month after a resolution is reached.

Is Low Volatility A Warning?

Low volatility isn’t a bearish omen in and of itself, and we found stock market volatility levels to provide much near-term directional help.

10-Year: Taper the Taper—Upside Limited

If interest rates keep going higher from here, we would run the risk of derailing a still-fragile recovery. As long as the Fed tapering uncertainty exists, we expect higher volatility on the 10-year yield to persist in the mean time.

10-Year: 185-245 Range Broken & Higher Volatility

We think 3% is the upper bound in the short term. However, we believe it will settle back closer to 250 bps by the end of the year.

Bi-Modal Or Middle Of The Road—We Think The Latter

How do we avoid volatility in a high Uncertainty/low conviction world? We compare a “bi-modal” portfolio of 50% Treasuries/50% High Yields with a “middle-of-the-road” portfolio of 100% Investment Grade Corporate bonds. The latter wins in both good and bad scenarios.

Expecting A Little March Madness

Things seem calm on the surface… is a little March Madness in store?

Are Low Volatility Equity Strategies The Panacea That People Are Talking About?

An examination of the low volatility stock anomaly and when it does or does not work... along with a look under the hood at the PowerShares Low Volatility ETF.

2011 Volatility Summary: S&P 500 And NASDAQ

Even though the major indices ended the year flat for the most part, volatility measures paint a different story.

Volatility—A Beast Worth Befriending Or An Enemy To Shield Away?

Better understanding the behavior of equity market volatility is a prerequisite for making improved decisions either as a way to profit directly from the changing nature of volatility, or as a way to hedge equity market exposure.

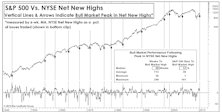

Using A Few Bear Arguments To Make A Bullish Case

Doug Ramsey utilizes several bear market arguments to build a bullish case. Rising Interest Rates, Overbought Market, Low Volatility, and Low Trading Volumes, can all be looked upon in a BULLISH light.

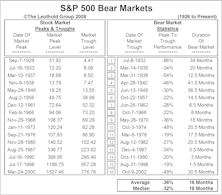

The Beginning Of The End.....Yes, We’re Talking About The Bear Market

September was a horrible month for the stock market, but now is not the time to be selling stocks. We believe a market bottom is close at hand, and this month’s “Inside The Stock Market” section presents several of our “big picture”, historical market studies to provide support for this belief.

Yearning For Those Summer Doldrums...

In the past, Wall Street activity slowed in August as professionals headed for the beach. However, the “Hyper-connected Era” has changed all that, as evidenced by higher market volatility in recent years during July and August.

Bulls May Have Christmas...

Bulls may indeed have Christmas, but fundamentals for bearish case in 2008 are extensive.