Dividends

S&P 500 Dividends? Thank You, No!

Dividends are a cornerstone of equity investing and over the decades they have produced a significant portion of the stock market’s total return. Previous Leuthold research has identified a strong dividend influence on total returns for small and midcap companies. Looking at S&P 500 constituents, we see that dividend growers outperformed companies that had flat or declining dividends – an expected outcome. However, we also found that companies not paying dividends convincingly outpaced dividend payers. This is contrary to the results in other market segments, but the explanation for this becomes apparent in the course of our research.

Research Preview: A Surprising Dividend Study

Dividends are a cornerstone of equity investing and, over the decades, they have produced a significant portion of the stock market’s total return. Previous Leuthold research has identified a strong dividend influence on total returns for small and mid-caps; a client recently asked if we found the same effect in the universe of S&P 500 companies. Specifically, have S&P 500 dividend-payers outperformed non-payers, and, second, have dividend growers outperformed non-growers?

Seeking Yield Among ETFs

The 2.00%-4.99% yield range is the sweet spot for yield investors from a risk/reward standpoint; while the other end of the spectrum (>5% yield) incurs too much risk for the fat payouts. Here we spotlight four ETF strategies that focus on dividend paying stocks.

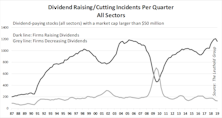

Return Implications Of Dividend Cuts

Last month we noted that current interest-rate expectations might indicate good timing for dividend investments; however, we strongly suggested being selective, and lean toward high-quality dividend payers.

Time For Dividend Stocks, But Stick With Quality

With multiple indicators flashing signs of an economic slowdown amid trade war uncertainty, investors are betting that an interest rate cut is on the horizon.

Cycles And Taxes And GICS, Oh My!

Analyzing quarterly financial results and developing insights about upcoming periods is always difficult, but the first quarter of 2018 was unusually complicated.

The Yin And Yang Of Utilities

Are Utilities defensives, or are they interest rate plays, or both? We believe the driving influence fluctuates based on market conditions, specifically fear, and the desire for protection in down markets.

Does Returning Cash Crowd Out Capex?

Companies are returning cash to investors at a level never before seen. Does the historically high level of cash being returned to shareholders crowd out the use of cash elsewhere? One wide-spread concern is that by shelling out cash through dividends and share buybacks, companies are spending less on capital expenditures. Is that a real concern?

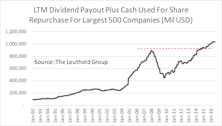

Can Companies Sustain Cash Payouts?

Companies are returning cash to investors at a level never before seen. Counting dividend payouts and outstanding share repurchases, the amount of cash returned back to investors crossed the $1 trillion mark for the first time in January 2016 (based on trailing twelve-months’ total for the largest 500 companies, Chart 1).

Too Early To Dethrone Dividend Stocks?

In the context of a low growth/low inflation environment, with the Fed taking its time to guide rates upward, fixed income type of investments may pale by comparison to dividend paying stocks.

Dividend Paying Strategies—Which Is Best?

Timing a dividend strategy based on interest rate trends is futile. Look for quality of dividend payers for long-term success.

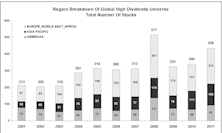

Sustainable Dividend Growers Turn From Europe To Asia

We dusted off our research from 2011 on dividend growers. Somewhat to our surprise, we found fewer qualifiers this time, and a shift from Europe to Asia.

Is The Dividend Mania Ending?

The list of new lows is dominated by yesterday’s darlings, “bond-like” stocks. In particular, Utilities and REITs have been hammered. However, not all of the stock market’s high yielders have been trashed.

New Dividend Growth Screen

A new dividend growth screen and another that additionally incorporates dividend growth at a reasonable price are explored.

Global Dividend Screen

Methodology for the new screen and the Dividend Sustainability Rank are discussed in detail. Dividend strategies continue to gain popularity, as equity investors grapple for yield.

Dividends Making A Comeback

Jim Floyd presents three screens looking for high (and healthy) dividend paying stocks. With bond yields so low, we believe there is opportunity in these types of stocks.

The Higher Payout The Better: A Global Perspective on Dividends and Buybacks

This month Chung Wang examines historical performance of companies that increase or initiate dividends, as well as companies that are buying back stock. These stocks tend to significantly outperform.

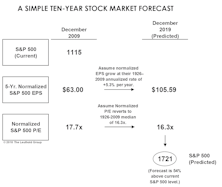

U.S. Stocks: What If The New Decade Is “Normal”?

While most are content to make annual predictions at this time, leave it to Doug Ramsey to bite off an even bigger piece…predicting the next DECADE.

How Investors Are Rewarding Management Decisions: A Global Perspective

There are four key decisions a company’s management has to make: Dividend Policy, External Financing, Capital Expenditure (Capex), and Research & Development (R&D). We studied how the market rewards each of these management decisions.

Q1 Dividend Cuts

Dividends have been garnering a lot of attention of late. We provide a list of S&P 500 constituent dividend changes and examine the implications of dividend cuts from an historical perspective.

Seeking "Normality" In Abnormal Times

Extrapolate the current state of affairs into the future at your own risk - “normalcy” is bound to return at some point.

Corporate Share Repurchases Now At Record Levels...Five Reasons Why They Are Expected To Slow

Share repurchases have been a major driver in the extension of the bull market, but this month’s “Of Special Interest” outlines several factors which are likely to contribute to a deceleration in corporate repurchase activity over the next several quarters.

View From The North Country

Leuthold’s thoughts about a potential near-term bull market correction, the current budget deficit, and observations on the political front.

View From The North Country

Dividends do matter, especially as an important component of total return. Also, a recent study published in the Financial Analyst Journal tries to get at the root of large cap, growth stock dominance in the 1990s.

Dividend Discount Models...Sensitive: Handle with Care

A March 30, 1998, WSJ piece reflects the optimism of this market, substituting earnings for dividends and ignoring any potential equity risk premiums.

Not For New Era Types

How much have dividends mattered in terms of historical stock market total returns, 1920 to date?

Putting Today’s Below-Average Dividend Payout In Historical Perspective

Our “Testing the Yield” histogram supports a cautious equity market posture based on historical limited upside potential in periods of low dividend yield levels.

“Real” Dividend Yield as an Analytical Tool

Testing indicates that there is really only minimal stock market analytical value to the concept of “real” dividend yields. It is of very limited use in identifying overvalued markets on a short term basis. Longer term, we found no stock market analytical value here.

Worth Noting

T-bonds are now clearly in the lead in the 1995 Performance Derby. Do dividend yields matter? Polling the pros in Baltimore and Boston.

Worth Noting

“Polling the pros” in April, adjusting stock market dividend yields for “buybacks”, mutual fund flows, looking beneath the Finished Goods PPI, and the possibility of rising inflation and interest rates.

Dividend Payout Ratios

In our view, the 1988 payout ratios below 40% do not (and should not) represent the start of a new contracting period in payout ratios. Rather, this current contraction is almost solely the result of the 1988 earnings explosion.

View from the North Country

Don Weeden’s two-in-one solution to the debt crisis…Do dividends matter anymore?

The 1987 Outlook

In this business, it is often best to conveniently forget what was said in the past. But unfortunately, when the opinions are written down and published, this does not always work. At any rate, this publication has a sometimes embarrassing commitment to full disclosure. So again, we will include our old (1986) crystal ball gazing right along with this year’s predictions.

Is 1986 Going to Be Another 1962?

The current 1974-1986 secular bull market period is similar to the 1949-1962 period (not 1921-29) in a number of ways. In this study, we compare earnings and dividend trends, as well as price action. If the 1949-1962 script is playing over again, the P/E expansion may be about over, with a non-economic bear market due.

Do Dividend Yields Mean Anything?

With the market in a growth stock atmosphere, many don’t think dividends are important, but some of us do.

Common Stock Dividend Yields and DJIA 3000

In this “In Focus” feature, 103 years of common stock dividend yields are compared. Today’s prevailing yields are put in historic perspective. Then various future stock market models are constructed, employing a variety of future earnings and dividend growth rates. Considering dividend yield history, the “super bulls” target of DJIA 3000 before the end of the decade seems close to impossible.