Large Caps

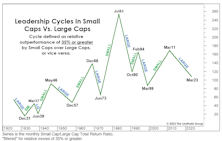

The Cycle That Never Was

At 144 months, this is now the longest Large-Cap cycle on record, but its dominance will have to prolong to eclipse the second-longest leadership phase (1946-1957), in which Large Caps achieved a 190% performance spread above Small Caps.

Normalizing The Abnormal?

In recent years, we’ve supplemented our longstanding normalized earnings technique with the simpler method of referencing any past peak in EPS (or, for that matter, trailing peaks in other corporate fundamentals, like cash flow and sales per share).

The “Donut” Might Be Healthier Than You Think

Lent ended last week, allowing Christians to resume the intake of unhealthy foods. But rather than a nice, thick T-Bone steak, we’d suggest sampling one of the few items that’s fattened investors’ accounts in 2022—the Donut!

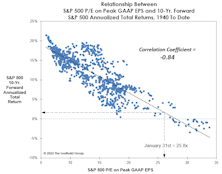

Bubble Or Not? Two Valuation Takes

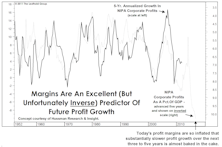

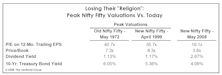

In early 2018, we thought the market was expensive, but certainly not a bubble. Today, the trouble is not just high P/E multiples, but the sustainability of the “E” itself—with profit margins nearly 20% higher than ever before. Whether one believes U.S. Large Caps are engulfed in a bubble or not, we have a P/E ratio for you.

Digging Out Of The Red

An unprecedented number of companies are still deep in the red, even while the economy is shrugging off the impact of the pandemic. Small-cap growth companies are showing no sign of a quick recovery.

A Pricey Alternative To The S&P 500?

This month we focus on the valuations of the MSCI USA Index—which is nearly identical to the S&P 500. This is worth following mainly because the folks at MSCI are kind enough to provide us with much longer-term histories of Cash Flow and Book Value Per Share.

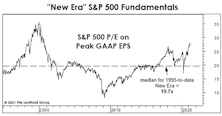

A “New-Era” Look At The Future

Young readers sometimes give us a not-so-subtle roll of the eyes when we discuss any sort of stock market history that occurred before their date of birth, but it takes experience to appreciate that “there’s nothing new under the sun—least of all in the stock market.”

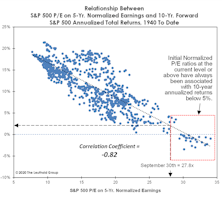

A Fast Start Comes At A Big Price

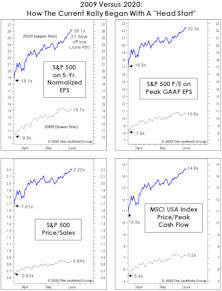

The first up-leg of the bull market has catapulted many Large Cap valuations to levels seen only in 1999, 2000, 2019, and pre-pandemic 2020. At the six-month point on September 23rd, the S&P 500 P/E on 5-Yr. Normalized EPS had already reached 26.9x—a reading that is 30% higher than at the same point of any other bull market.

The Wrong Kind Of “Head Start”

The rally’s initial resemblance to the first up-leg off the secular 2009 market bottom is remarkable. Both rallies started in March, and achieved gains of almost 40% within 50 trading days. Both, of course, sprung from a backdrop of unprecedented monetary stimulus.

A Bear Market In Price, But Not Time

We have a hard time accepting that the excesses associated with an eleven-year bull market and expansion can be fully expunged in 27 trading days, no matter how ugly those days were… keep some powder dry!

A Good Year To “Own It All”

It’s no surprise that U.S. Large Caps were the #1 asset class performer in 2019. We were surprised that last year was the only one of the decade in which the S&P 500 won the annual performance derby. Here we review the annual performance of “Bridesmaid” asset class and sector, “Perfect Foresight,” and Lowest P/E sector.

Valuations: An Updated “Modern” Take

An occasional critique of our valuation work is that we consider “too much” market history to form a judgment as to what constitutes “high” or “low.” This type of feedback declined during and after the financial crisis (when historic valuation thresholds were temporarily revisited), but it has become more pointed as the U.S. market has soared to new highs.

Risks Still High In The “Median” Large Cap

The relative domination of Mega Caps might leave the impression that valuation of the “typical” (or median) Large Cap stock is reasonable. It’s not. The fall rally leaves all major valuation ratios for the median S&P 500 stock in the top decile of the 30-year history, and above the levels prevailing at the September 2018 market high.

We’re All Economists Now!

It’s now been more than 19 months since global stocks peaked on January 26th, 2018. Those lucky enough to have been invested solely in the S&P 500 and to have held on for the volatile ride have a 3.7% gain to show for it. Nice going.

Try This On For Size

Today’s market is barbelled regarding company size, with the mega-cap Tech stocks and the S&P 600 Small Cap index both outperforming the middle of the S&P 500.

Small Cap vs Mid Cap vs Large Cap

After spending two months in discount territory, in March the Ratio of Ratios headed closer to its historical median premium of 4%.

Navigating The First Rate Hike

Our current view is the lift-off will be December or later. Assuming inflation will pick up and the Fed hikes the rate by the end of 2015, stocks will perform relatively well, with international stocks a better bet than U.S. stocks.

Stocks Vs. The Dollar—More Complicated Than You Think

The recent strength in the dollar coincided with a spike in volatility and weakness in risky assets, but the relationship over the last couple years has been tenuous at best.

Small/Mid/Large Caps

Small Cap Premium Bounces Back To 23%

Small/Mid/Large Caps

Small Caps are selling at a 20% valuation premium relative to Large Caps (23% last month), using non-normalized trailing operating earnings.

Small/Mid/Large Caps

Small Cap Premium Continues Upward To 23%. Large Caps Lead On The Downside In January

Small Cap Update

Small Caps are close enough to a new relative strength high that it’s possible a final revision might be necessary before the Small Cap tide flows out.

Small/Mid/Large Caps

Small Cap Premium Continues Upward To 21%. The red-hot equity market of 2013 was especially good for Small Caps with a +38.8% total return.

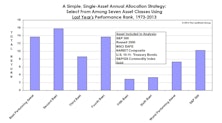

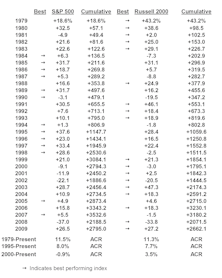

Buy The Bridesmaid, Not The One Looking To Rebound

The investment leadership of a given year has historically had better-than-even odds of outperforming in the following year at both the asset class and equity sector levels.

Small/Mid/Large Cap Internals

Small Caps are selling at a 20% valuation premium relative to Large Caps, using non-normalized trailing operating earnings.

Small Cap Premium Ticks Up To 16%

Small Caps are selling at a 16% valuation premium relative to Large Caps, using non-normalized trailing operating earnings. Using estimated operating earnings, Small Caps are selling at a higher valuation premium of 23% (25% last month).

How Long Can Small Caps Lead?

The Russell 2000 is about five points ahead of Large Caps YTD, and is approaching its April 2011 long-term relative peak. We view this outperformance as their leadership’s last gasp and not a new cycle.

Small/Mid/Large Caps - Small Cap Premium Slips To 14%

Small Caps are selling at a 14% valuation premium relative to Large Caps, using non-normalized trailing operating earnings. This is down slightly from last month, and ranks in the 91st percentile of the 1983-to-date history of this measurement.

Small Caps Lead Year-To-Date

Large Caps lost 2.9% (total return) in August, just ahead of Small Caps (-3.2%) and Mid Caps (-3.8%). YTD, Small Caps continue to perform ahead of the other two subsets.

Small Cap Premium Remains 15%

Small Caps are selling at a 15% valuation premium relative to Large Caps, using non-normalized trailing operating earnings. This is the same as the past two months’ readings. Using estimated 2013 operating earnings, Small Caps are selling at a higher valuation premium of 23% (24% last month).

Sector Margins: Just Thank The Consumer

We’ve noted before that profit margin gains since the technology boom have been primarily a Large Cap phenomenon.

Small Caps Lead Year-To-Date

Large Caps gained 5.1% (total return) in July, lagging Small Caps (+7.0%) and Mid Caps (+6.2%). YTD, Small Caps are now ahead of the other two subsets, and Large Caps are the laggards.

Small Cap Premium Remains 15%

Small Caps are selling at a 15% valuation premium relative to Large Caps, using non-normalized trailing operating earnings. This is the same as last month’s reading. Using estimated 2013 operating earnings, Small Caps are selling at a higher valuation premium of 24% (25% last month).

The Disappearing "Large" Effect And Emerging Market Performance

While U.S. stocks have surged this year, Emerging Markets have languished. What is going on in Emerging Markets to cause this unusual situation?

Quality As An Investable Stock Selection Concept

In this note, we discuss our market-level measure of quality, and highlight an expanded methodology for determining the “quality” of a stock and the performance implications associated with such a concept.

Small Cap Stocks: Hard To Make The Numbers Work…

Leuthold’s Doug Ramsey takes an in depth look at historical Small and Large Cap cycles and offers insight as to where we stand now and what can be expected going forward.

Predictions for 2012…

From the stock market to politics to football, Doug Ramsey offers up ten predictions and thoughts for the New Year…. Even though we’ve already had a one month “peek” at 2012.

Profit Margins: As Good As It Gets

Current record high corporate Profit Margins examined in this month’s “Of Special Interest.” Topics include the sustainability of the trend, commodities as profit trackers, margins as a potential forecasting tool and discussion on profits by sector and market cap.

Large Cap Versus Small Cap: Performance Parity 1979 To Date

Over this entire period, the S&P has narrowly beaten the Russell 2000, but not by much.

The New Nifty Fifty—Time To Become A Believer Again?

These once elite companies have continued to turn in good earnings growth. The problem had been that the prices had moved far too high. After a few years of declining prices, the valuations are once again looking very compelling.

.jpg?fit=fillmax&w=222&bg=FFFFFF)

.jpg?fit=fillmax&w=222&bg=FFFFFF)