Leadership

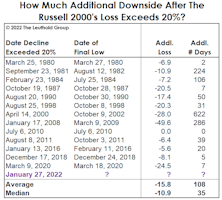

Two Ways To Spin The Russell 2000 “Bear Market”

At the market’s January 27th close, the headline blared, “Russell 2000 Enters Bear Market.” Well, not exactly. If one accepts that a 20% decline constitutes a bear market, then the bear actually began on November 9, 2021—the day after the Russell 2000 peak.

The “Tape” Doesn’t Always “Tell All”

Technicians are collectively bullish because of the absence of any serious internal divergences. But, severe corrections can erupt with little, or no advance warning from a deterioration in breadth and leadership. In fact, the first few years of the last bull market provided two such examples (mid-2010 and mid-2011).

Everyone Loves A Winner

The bullish consensus seems to be that unlimited Fed liquidity will lift all stock market and economic boats. However, past liquidity floods have tended to lift boats that were already the most buoyant. The “Y2K Liquidity Facility” and last fall’s emergency Fed intervention in the overnight repo market are two cases in which liquidity seemed to flow to where it was needed the least.

The Bull Is Dead, But The Leaders Live On

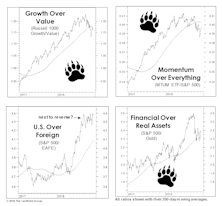

The bull market of 2009-2020 is no longer. But its spirit—its leadership—has somehow lingered, right through the worst of the decline and during the eleven-day, +19% S&P 500 bounce that followed.

Closing The Books On Another “1999”

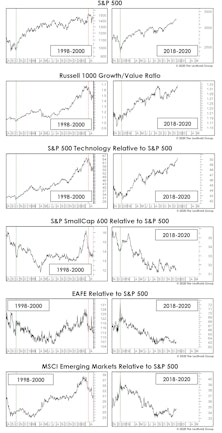

It’s been a while since we looked at 2019’s stock market parallels to 1999. Sorry about that… we’ve been too busy reliving 1999 on almost a daily basis, and often not in a good way.

A New Take On Small Cap Valuations

For valuation work, we’ve traditionally favored the 1,200 company Leuthold Small Cap universe over the S&P SmallCap 600 because we get almost a full additional decade of perspective. But figures for the latter shed extra light on just how significant the revaluation in Small Caps has been.

“Quant Quake” But No Market Quake

Value, High Beta, and Small Cap stocks all captured a few rays of sunlight for the first time in a long while. It’s too early to tell if last month’s leadership U-turns can be sustained, but major market trends are the most susceptible to reverse during cyclical bear markets.

Is The Patient Too Old For A Transplant?

This week’s massive stock market leadership flip has certainly remedied some of the breadth weakness we discussed in this month’s Green Book. But we can’t help wonder whether the move is analogous to performing a transplant on a 95-year-old. The patient might survive the surgery, then die while under anesthetic.

Rally Like It’s 1999

Similarities between 2019’s YTD up-move and the late-2018 recovery are so striking they must make even the most vociferous bear queasy. The trends are identical, but the magnitude of both the absolute and relative performance movements was greater in the earlier experience.

Partying Like It’s 1998-99

We thought Jerome Powell’s “Christmas Capitulation” would be tough to beat, but he accomplished that two days ago with what could be called his “Spring Surrender.” That, in turn, has rekindled hopes of a stock market melt-up along the lines of 1998-99, which, as old-timers will remember, followed a late-cycle correction that was nearly identical to the one seen last year.

New Year, Old Leadership

We’ve written at length about a bear market’s tendency to catalyze major leadership changes—across sectors, styles, and even geographies.

Sizing Up The Rally

There’s an old saying that bear market rallies look better than the real thing, yet the upswing off December lows looks even better than the typical bear market rally.

It’s Not A Pause… It’s “Paws”

A bear market will almost always prove to be the catalyst of one or more shifts in long-term market leadership.

The Bulls And Bears Agree!

Yes, bulls and bears now hold their respective positions for the same reason—i.e., the U.S. economy is exceptionally strong. The stock market is accommodating this rare bipartisanship with sufficient reason to support either position.

Is Small Cap Leadership Bullish?

The Russell 2000 closed above its January 26th high on Wednesday, and well beforehand bulls had seized upon the secondary stocks’ leadership as evidence that all is right again with both the U.S. economy and stock market...

The Ups and Downs of 2018

Ten weeks into 2018, we have already seen three mini-cycles in U.S. equities. A rip-roaring surge in January was followed in early February by one of the shortest corrections in history...

Most Likely Just A Correction

So, what happened to the January Barometer—the old analyst’s maxim that a market gain in January portends a gain for the full year?

Stock Market Observations

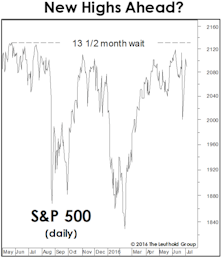

With the S&P 500 levitating near its all-time high, stock market leadership is peculiar—characterized by a flight to quality. And, despite the market’s violent bounce off February lows, there have been only four new market highs set by key indexes on our “Bull Market Top Timeline” table.

Foreign Stocks Set For A New “Bear”-ing?

Based on comparative valuations alone, one could have made a case for investing in foreign stocks over domestic ones as early as 2010—when EAFE’s valuations sunk to an historical low, relative to the S&P 500. Today, that gap remains extreme.

“Top In” Or “Topping Out?”

The stock market rally has carried far enough to flip some of our trend-following work bullish, lifting the Major Trend Index to a low-neutral reading. The improvement prompted an increase in asset allocation portfolios’ net equity exposure to 42% (up from 36% previously).

Stock Market Observations

This bull market has appeared to be on shaky technical ground before, only for concerns to be swept aside. This time, we think it’s different.

On High Alert

August is “National Eye Exam Month,” but this is the rare year we can confidently recommend that you skip it.

Weakening Foundation

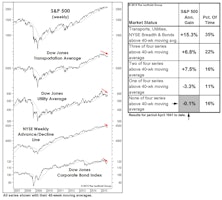

Over the last few months, we’ve presented a couple of simple quantitative studies meant to encapsulate the factors driving our Major Trend Index to the brink of bear territory. The chart and table might provide the best summary yet.

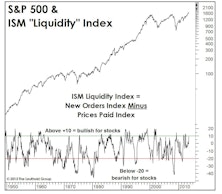

Fed Watching For The 21st Century

Deteriorating stock market breadth and worrisome leadership trends both suggest liquidity has already tightened; whether the Fed follows suit in September may now be just a formality.

Leadership: Winning Begets Winning

Many assume that stocks and industries exhibiting high price momentum suffer disproportionately during the eventual bear market. Surprisingly, the high momentum stock portfolio has suffered an average bear market loss that’s about a quarter less than that of the low momentum portfolio.

Flying By Instruments

The safest highs to sell in the stock market are “lonely” new highs. Fortunately, the April 24th bull market high in the S&P 500 was anything but, as that index enjoyed a varied swath of Large Cap, Small Cap, and foreign company (although the DJIA was a mysterious no-show).

Two Takes On The Ticker Tape

Conventional breadth measures show the U.S. market to be healthy, with key indexes confirming the April 24th S&P 500 high. However, sector leadership is behaving in a way that’s consistent with an approaching market top.

High Quality Stock Leadership Stalled

Last time we updated this work, we were surprised by how much High Quality stocks had outperformed. In Q4 2014, High Quality stocks were up 9.6%, while Low Quality stocks had edged up only marginally (+0.3%).

2015 Leadership: An Early Take

Last year’s economically defensive winners held their grip on stock market leadership in January. This action is consistent with our view that the bull market is an aged, overvalued one that has begun a final “distribution” process that will eventually erupt into a cyclical bear.

Small Caps: A New Ratio!

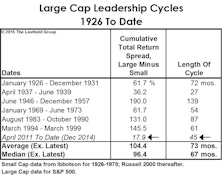

Small Caps lagged the S&P 500 by almost ten percentage points in 2014, but their underperformance streak technically dates back to April 2011. Nonetheless, their cumulative, 45-month underperformance in relation to the S&P 500 (now about –18%) is still modest enough that any mention of the current “Large Cap Leadership Cycle” is bound to draw a few head scratches.

Stock Market Observations

Market gains have been less broad than in 2012 and 2013; market direction and leadership have been mismatched; and quantitative factors have been choppy.

Can The Dollar Save Small Caps?

The dollar’s moonshot in recent months has resuscitated a stock market leadership argument we haven’t heard for a long time.

The Surprising Winners In Emerging Markets

While we expect an eventual break in this relationship, today Emerging Market equities are following, fairly tightly, the cycle of industrial commodities—a cycle that rolled over (on a secular basis, we believe) in 2011.

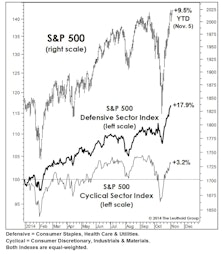

What To Make Of Market Leadership

The renewed embrace of risk hasn’t extended to the sector level. After resisting decline in late September through mid-October, defensive sectors have matched the rebound in Cyclicals, almost point for point.

Market Internals: The Good And The Bad

Leadership isn’t warning of impending weakness in either the U.S. economy or the stock market. Market breadth, on the other hand, is highlighting risks that aren’t evident when inspecting leadership alone.

The Economy And Earnings

The YTD surge of 19% in the S&P 500 should ensure a stronger second half economy, and the big five-point jump in the latest Purchasing Managers Survey (ISM) might be the first evidence of this.

Leadership: More Of The Same?

Market valuations and investor sentiment are a bit too inflated for our comfort, but the catalyst of the MTI’s drop to Neutral status two weeks ago was simply the action of the stock market itself. Specifically, we haven’t liked the disjointed nature of U.S. market action since about mid-March, where high-yielding and economically-defensive stocks have done the heavy lifting in the Dow and S&P 500 moves to all-time highs. This isn’t so much a change in leadership as an acceleration of an existing trend, and it’s now pronounced enough to weigh down a few of our technical measures.

Nice Gains… But In The Wrong Groups

Sure looks like a bear market rally rather than start of new bull market. Many global indexes still down 20% or more from peak levels.

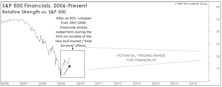

Thoughts On Long-Term Leadership

Bubble groups rarely return as market leaders until after experiencing a prolonged trading range pattern. Technology currently appears to have paid its dues and could develop into the next market leader.

Reasons To Own More Stocks

Looking for reasons to own more stocks? Doug Ramsey has a whole bunch of them.

.jpg?fit=fillmax&w=222&bg=FFFFFF)

.jpg?fit=fillmax&w=222&bg=FFFFFF)

.jpg?fit=fillmax&w=222&bg=FFFFFF)

.jpg?fit=fillmax&w=222&bg=FFFFFF)