Performance

Feeble Bull Or Hibernating Bear?

At last October’s lows, we had yet to see any manner of economic, monetary, and valuation “reset” that would clear the path for a resilient cyclical bull. And, in the 51 weeks since that bottom, U.S. economic, monetary, and valuation conditions have only deteriorated further.

Pause, Or Paws?

The one-year anniversary of the 2022 bear-market low occurs on October 12th, yet—after all this time—we’re not confident enough to declare it as the bull’s first birthday.

We’re interested to see whether or not CBNC breaks out new baseball caps for the occasion, as they did in the late 1990s for “Dow 10,000.”

New Policies, Old Outcome

At long last, we’ve exited an investment world that was defined for more than a decade by zero interest rates and Quantitative Easing. Or so we thought.

Active/Passive: Data Refresh Through Q1-2023

The performance derby between actively managed portfolios and passively managed index funds is a fascinating and important topic in the investment community at large. This note provides a brief update our previous studies through the first quarter of 2023.

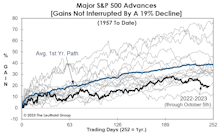

Checking In On The Rally At The Six-Month Point

Yesterday was the six-month anniversary of the bear market low of 3,577.03 in the S&P 500. We think it’s unlikely the moderate upswing since then represents a new cyclical bull market. However, with the evidence still weighing in at Neutral, we’re not betting the farm on that opinion.

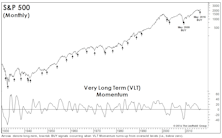

VLT: A Double-Sworded Edge

“Oversold” usually has a positive connotation in financial jargon, yet history’s worst air-pockets have almost always occurred when the stock market was deeply oversold. More time is needed before a “low-risk” entry point for the S&P 500 will be triggered from the VLT’s currently “oversold” status.

Your “Free Lunch” Comes With A Tab

The market impact from money printing has been underwhelming when adjusted for the inflation it’s unleashed. Measured from the peaks associated with the first attempt at Quantitative Tightening, in inflation-adjusted terms, Small Caps, EAFE, and Emerging Markets all have losses.

Digging Out Of The Red

An unprecedented number of companies are still deep in the red, even while the economy is shrugging off the impact of the pandemic. Small-cap growth companies are showing no sign of a quick recovery.

After The SPAC: De-SPAC Performance

The ultimate measure of a SPAC sponsor’s success is stock performance post merger: De-SPAC results. We analyze historical returns of De-SPACs that had initial market caps greater than $200 million.

A COVID Weight-Loss Program For The 4% Club

While we’re still squeezing into our pants and fretting over our newest chin, the S&P 500’s three-largest firms have been shedding their COVID-weight gain at a measured pace for months. Whereas most people drop the pounds through vigorous activity, these firms have managed to slim down just by standing still.

Stocks And Yields Revisited

The S&P 500 and 10-Year Treasury bond yield could accomplish something fairly rare today by closing at “joint” 52-week highs. The relevant levels to meet or exceed are 3934.83 on the S&P 500 and 1.49% on the bond yield.

How It Bodes For Biden

Early evidence suggests the Biden administration and the newly “purple” Senate will resist the pull of the far-left, at least from an economic perspective. Stock investors are cheering... though in light of their current euphoria, they might as well have celebrated a write-in victory for Ralph Nader alongside Green Party control of the Senate.

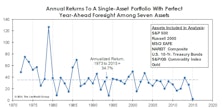

Bridesmaid Track Record

With last year’s Bridesmaid (REITs) having laid an egg, the long-term “alpha” of the Bridesmaid portfolio narrowed to +3.7% from a bit over +5% (annualized) when we first published this study more than a decade ago.

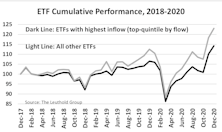

The Relationship Between ETF Fund Flow & Future Returns

In April 2018, armed with a large number of ETFs and long-enough historical data, we applied our back-testing methodology for individual stocks to the universe of ETFs to determine if the same (or some) of those components could useful for assessing ETF performance prospects. One of the factors we reviewed was fund flow (adjusted by AUM), which revealed that those ETFs experiencing the largest asset inflows proceeded to significantly underperform.

SPACs: More Analysis Of Past Deals

Last month, we briefly discussed a burgeoning investment vehicle—Special Purpose Acquisition Companies (SPACs), also known as “blank-check companies.” Since the sole purpose of a blank-check company is to find an operating business to merge with, and subsequently bring it public, the best method to gain some understanding about the outcome of these relationships is to look at past deals.

After The “Thrust”…

We’re concerned that cyclical groups, which normally catch fire after a breadth thrust, are tracking along the bottom (or below) the previous worst-case outcomes following identical breadth-thrust signals.

Should You Trust The Thrust?

There are two concerns with the latest bullish thrust signal, with one, in part, causing the other. First, the S&P 500 return preceding the MBI thrust signal was +42.8%, almost triple the average slippage of +15% associated with all prior signals.

The Active Goose, The Passive Gander

Raise your hand if you’ve heard this one before:

(A) 80% of active funds underperformed their index over the past 10 years.

Now, keep your hand up if you have also heard this:

(C) Therefore, investors should buy passive index funds.

Utilities Sector: What’s Driving YTD Performance?

We review the somewhat out-of-character performance of the Utilities sector to try to pinpoint what is influencing results. This article touches on several potential drivers for the sector’s relative strength.

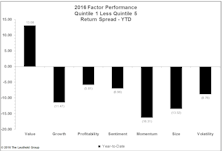

Factor Failure: Don’t Blame FANMAG

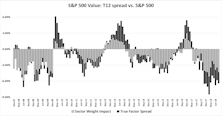

Our recent commentary “1” For The Record Books noted that just one of seven S&P smart beta factors was able to outperform the S&P 500 last year, even though each style basket limits its holdings to constituents of the parent index.

The Easy Fed and the “Other” Inequality

Super-easy monetary policy has been blamed for the rise in income and wealth inequality in recent years, and more recently we’d fault the Fed for performance inequality within the stock market.

Taking A Punt On U.K. Stocks?

The June 2016 Brexit referendum kicked off a tortured process for the United Kingdom to leave the European Union. However, the wheels of international politics turn slowly, and the original date of formal withdrawal was set as March 29, 2019. As the calendar rolled into 2019 it became obvious that the March closing date was not going to be met, and concerns mounted over delays, procedures, deal-or-no-deal, a new prime minister, and even calls for another vote.

Worrisome Profitability Trend Among Small Cap Companies

Despite a historic economic expansion during the past decade, there is an ever-increasing number of companies that are finding profitability has become harder to achieve.

Sector Concentration And Effects On Country Performance

Is the performance of certain countries mainly driven by particular sectors? And, does U.S. sector performance drive the performance of other countries? (i.e., when U.S. Financials underperform, do foreign countries with large Financials sector weights underperform?). We did some data crunching to address the second question.

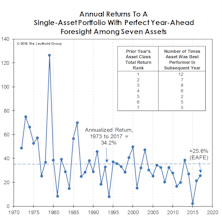

“De-Worsification” Ruled In 2018!

The market difficulties of 2018 were hardly limited to stocks. Commodities, in fact, were the worst performer among the seven major asset classes.

3% Yields Proved To Be High Enough

In September the popular claim was that “interest rates were rising for the right reasons,” and still too low to threaten stocks or U.S. economic expansion.

Narrow Performance Divergence Among EM May Not Last

We’ve previously noted the narrowing performance divergence between top- and bottom-performing Emerging Market (EM) countries in recent years.

Research Preview: Sector-Adjusted Factor Returns

This article summarizes our current research into the interaction between factors and sectors. We find that sector weights have a significant influence on some factor results, while the true factor impact is the key driver for others. Watch for our full report coming next week.

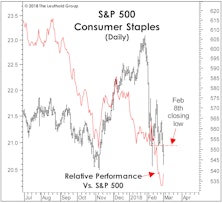

What’s Ailing The Staples?

The setback that began in late January qualifies as the sixth intermediate correction of the current bull market, where “intermediate” is defined as an S&P 500 loss ranging between 7%-12%...

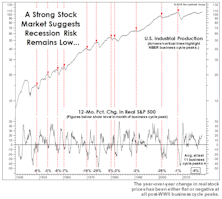

Recessions & The Stock Market

In the last couple of months, we’ve come across a handful of economic “check lists” purporting to show the relative absence of recession harbingers as the expansion closes in on its ninth anniversary this summer.

Bridesmaid Strategy: Picking The Year’s Best Asset

Here’s another way to look at the persistence of momentum across asset classes for the last 45 years.

A Study On Closed End Funds

In March 1991, an article titled “Investor Sentiment and the Closed-End Fund Puzzle” was published in The Journal of Finance.

The Intelligent Use Of Smart Beta

Quantitative investing has become an integral component of professional investment management, and smart beta funds have become popular vehicles for advisors as they assemble actively-managed client portfolios.

Quantitative Factor Performance: Year In Review

Factor performance during 2016 is the reverse of that of 2014-2015. Quants and smart beta funds focusing solely on Value have enjoyed the year, while multi-factor approaches have struggled. Value has been the only factor that has provided positive performance this year.

Not Much “Lift” From VLT “BUY”

In the June Green Book, we professed some skepticism surrounding the long-term, “low-risk” BUY signal for stocks that was triggered at the end of May by our Very Long Term (VLT) Momentum algorithm (also known as the Coppock Curve).

“Index Rebalance Effect” Once Again Proven

Validating results of a prior study, a look at the last four MSCI index rebalances shows that stocks soon to be added outperform from Announce Date to Effective Date, while deleted stocks underperform.

The Fed’s Capitulation To The Dovish Side— A Win-Win For EM & U.S.

We have mentioned a number of times that China had experienced a very unpleasant “second-hand” tightening due to its peg to the dollar. Its trade competitiveness has suffered tremendously. With a weaker dollar the Chinese Yuan can re-gain some of its competitiveness while maintaining its peg to the dollar. A rare win-win in today’s convoluted world of finance.

Asset Allocation: No Upside In 2015

Hedge funds have shuttered by the dozen in the past few weeks, with the worst carnage among those focused on Emerging Markets and commodities. But the problem is broader.

The Pause That “Depresses”?

The blue chip U.S. indexes have gone nowhere in 2015, and we expect bulls will soon write off the year as the “pause that refreshes.” But what’s been refreshed?

New Month, Old Worries...

While the S&P 500 had erased all but 2% of its August loss as of early December, Small Caps and the “average stock” had recouped only about half their correction losses. Not good.

.jpg?fit=fillmax&w=222&bg=FFFFFF)

.jpg?fit=fillmax&w=222&bg=FFFFFF)

.jpg?fit=fillmax&w=222&bg=FFFFFF)

_Page_1.jpg?fit=fillmax&w=222&bg=FFFFFF)

.jpg?fit=fillmax&w=222&bg=FFFFFF)