Recovery

Yet Another Late-1990s’ Comparison

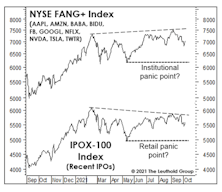

The post-COVID surge in the NASDAQ 100 has been a perfect match in terms of duration with the one following the crisis afflicting Russian debt (and the LTCM debacle) in the fall of 1998. Incredibly, both of these historic market moves lasted 369 trading—but that’s where the resemblance ends.

Deep Thoughts On The Recovery

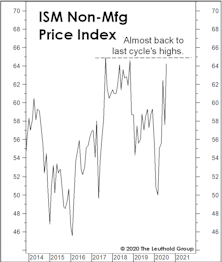

Massive gains in stock market wealth have undoubtedly been a contributor to inflation, yet few analyses of the inflation picture even mention the stock market—other than to predict it will soar when inflation proves transitory.

The EPS Recovery And "The Cycle"

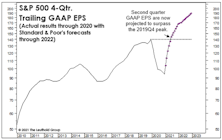

In a couple of weeks, final second quarter EPS for the S&P 500 will confirm the fastest recovery ever from a recession-related earnings decline. That’s old news, and before it has even hit the tape. But we’ve had a sneak peak from the monthly, 12-month trailing EPS numbers published by MSCI for its USA Large Cap Index. Those figures showed that EPS exceeded their pre-COVID peak in May, and the latest reading (through August) is already 22% above the prior high! Simple trendline analysis suggests that EPS for U.S. Large Caps are likely higher today than they would have been in the absence of the COVID pandemic and hyper-stimulative response.

Sizing Up The Profit Recovery

We don’t make much use of “Forward” EPS for the S&P 500 because analyst forecasts have tended to be hopelessly optimistic. But if their short-term projections are on target, when numbers for the current quarter are reported, 12-month trailing GAAP EPS will exceed the $139.47 pre-COVID peak.

An Unwelcome Surprise?

Several measures of U.S. economic “surprises” have soared to all-time highs in the last couple of months, showing that even economic forecasters have finally learned to play the corporate game of “under-promise then over-deliver.” Mind you, that’s only 30 years after most industrial firms eliminated the role of “staff economist.”

2020 Earnings And The Extremophile Market

As we wade into the waters of second-quarter earnings, muddied by economic shutdowns and suspended guidance, we thought it might be a good exercise to pull back from the “micro” of firm-level beats and misses and examine the “macro” picture that is the Great Earnings Washout of 2020.

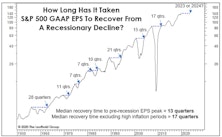

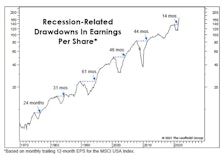

Mapping Out The Eventual Earnings Recovery

We view the coronavirus pandemic as the final straw that tipped an already vulnerable U.S. economy into recession, rather than the watershed event that will change the way we view growth, profitability, and even the nature of work itself. But even economic “optimists” like us need to recognize that the recovery back to last cycle’s earnings peak will be a long and grinding one. There’s a good chance that the four-quarter trailing S&P 500 GAAP Earnings Per Share cycle peak of $139.47 will not be exceeded until 2023 or 2024 (Chart 1).

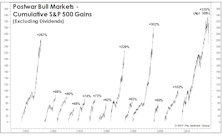

Bull Markets Are In The Eye Of The Beholder

The market’s four-month recovery from the brink of a bear was completed in April, and the ten-year-old bull looks better than ever against all of its post-World War II competitors.

Rally Like It’s 1999

Similarities between 2019’s YTD up-move and the late-2018 recovery are so striking they must make even the most vociferous bear queasy. The trends are identical, but the magnitude of both the absolute and relative performance movements was greater in the earlier experience.

Leuthold Quick Takes: Cyclical Bear Or Recovery Refresh?

The fourth quarter selloff and subsequent rebound, as seen by Doug Ramsey (Chief Investment Officer) and Jim Paulsen (Chief Investment Strategist).

Leuthold Quick Takes: Cyclical Bear Or Recovery Refresh?

The fourth quarter selloff and subsequent rebound, as seen by Doug Ramsey (Chief Investment Officer) and Jim Paulsen (Chief Investment Strategist).

Breakout Or Fake-Out?

The S&P 500 has fully erased its January and February losses, but there’s probably a market message in the fact that it took so long to do so.

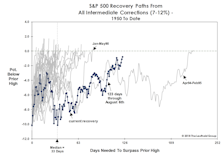

A Launching Pad??

A few clients pointed out that the longest-ever recovery from an intermediate correction (Apr. 1994–Feb. 1995) became the base from which the S&P 500 would eventually triple over the next five years. We’re not equipped to address that possibility in an objective fashion, so we’ll let you be the judge.

Where’s The Spring In The Step?

Old age alone may not kill the bull, but it can make it more susceptible to an array of life-threatening maladies.

Is The Bull Just Napping?

Old age has certainly put no limitations on the bull’s exploits, so we should be cautious in reading too much into its meandering recovery path. However, it’s possible that action since the February low is not a recovery process but rather a countertrend bounce within a larger downtrend.

The “Correction” Clock Is Ticking

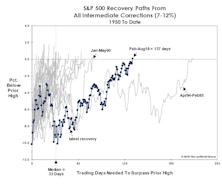

2018’s S&P 500 setback qualifies as an “intermediate” correction. Historically, the duration of intermediate corrections is brief, and recovery time to move back above prior highs has also been brief. This year’s retracement route is already among the most meandering of all recovery paths since 1950.

Market Corrections And The Hazards Of Old Age

In difficult markets, we have become more appreciative of some of life’s small gifts. For example, it’s been quite a while since we’ve heard it argued that this is “the most hated bull market of all time.”

Putting “Our Spin” On The Positive Spin

Bull markets seem to create their own moods that lead to fundamental developments being viewed in a mostly favorable light.

Anatomy Of A Correction

While the current market setback of –5.8% doesn’t qualify as an intermediate correction, it’s close enough to the threshold to warrant a quick review of what such a correction—and the ensuing recovery—might look like.

10-Year: Taper the Taper—Upside Limited

If interest rates keep going higher from here, we would run the risk of derailing a still-fragile recovery. As long as the Fed tapering uncertainty exists, we expect higher volatility on the 10-year yield to persist in the mean time.

“Just Another” Summer Correction

After annual summer correction re-run, we believe the market swoon is over, having produced a garden variety correction of -7.2%.

The 1974-1982 Template For Recovery

Current market recovery continues to track the post 1974 bear market recovery quite closely.

The Stampede That Wasn't

A month ago we suspected June might see a big institutional rush into the stock market. The stampede never came, though, and the market finished essentially flat for the month.

Sector Ups and Downs During Bear Markets And Recoveries

Info Tech has demonstrated an ability to lead coming out of bear markets, but still not seeing overall GS Score strength in the sector.

Stock Market Recovery….Typical In Duration, But Maybe Not In Terms Of Performance

Based on post WWII stock market recoveries, the current recovery could have some more upside (12% possibly).

Assessing The Cycle….Putting Today’s Growth Into A Historical Context

Within the current cycle, the stock market recovery is mature, but based on the average post WWII recovery could still have some upside (S&P 500 to 1400?). Currently, earnings growth is well beyond historical averages, but the economic expansion is below the norm.

Third Year Of Bull Market...Now Well Beyond Range Of Typical Bull Market Cycle Peaks

A comparison of the performance of the current stock market recovery to the monthly performance averages of past recoveries (1900 to date).

Third Year Of Bull Market...Assessing The Current Cycle From A Historical Perspective

A comparison of the performance of the current stock market recovery to the monthly performance averages of past recoveries (1900 to date).

Third Year Of Bull Market...Assessing The Current Cycle From A Historical Perspective

A comparison of the performance of the current stock market recovery to the monthly performance averages of past recoveries (1900 to date).

Third Year Of Bull Market...Very Late In Cycle, But Still Potential Upside

Stock market now it is third year. Based on the average performance, this may be getting long in the tooth.

Today's Economic Recovery In Perspective

The current expansion is below the average pace of a typical expansion.

Performance Expectations For Third Year Of Recovery

Based on study of bear market recoveries dating back to 1900, the third year of the recovery is typically not strong. However, this current recovery has lagged the normal recoveries in terms of performance.

Take A Wait And See Attitude For February

February sure came in like a bull, with the S&P 500 already up 1.8% through February 4th, while the NASDAQ has risen 1.1%.

Getting Later In The Game For The Bull Run

Getting late in the game for the bull run. This is no longer a young bull market, but we continue to believe the market can still move higher from here.

Tracking The Market Recovery…..A Mature Bull Market

Current recovery tracking below the performance averages of past bear market recoveries.

Today's Economic Recovery In Perspective

Current economic recovery may appear to be lagging, with a GDP growth rate of +3.6% ACR since Q1 2001, but most recent five expansions averaged +4.2% ACR and the big 1990-2000 expansion grew at only 3.4% per year. Economy is still healthy.

Tracking The Market Recovery…..Bull Market Maturing, But Still Some Upside Potential

Based on the typical recovery, we constructed a series of monthly price targets for the S&P 500, going out 24 months from the October 9, 2002 bear market low, and from the March 11, 2003 secondary low.

The Certainty Of Uncertainty

Uncertainty in Iraq, terrorist threats, rising inflation, and higher interest rates (and Fed tightening) have taken center stage against a backdrop of impressive corporate earnings momentum and economic recovery.

Market Mood Swings

Bull market still intact, but investor appetite for risk remains subdued. April’s preference was for defensive and conservative strategies. Old axiom “Sell in May and go away” doesn’t seem to apply during the 130 days leading up to election day.

Tracking The Market Recovery…..Still 13%-16% Potential Upside

Although the biggest gains are behind us, based on 1900-to-date, past bull market recoveries, the stock market still has potential upside of 13-16% over next 6-9 months.

.jpg?fit=fillmax&w=222&bg=FFFFFF)