U.S. Dollar

U.S. Dollar—Still The Cleanest Dirty Shirt

The U.S. dollar broke below its recent support; its weakness has been a dominant driver of risky assets and its direction will be an important determinant of the current rally.

Tactical Tools For A Stronger Dollar

The 2022 bear market has been driven by collapsing valuation multiples, particularly for expensive growth stocks and unprofitable companies. Coming into the year, U.S. stocks stood as one of the most egregiously valued equity markets around the world, motivating investors to look elsewhere for more reasonably priced alternatives. Fortunately, international stock markets offered much better valuations that could serve as havens from the coming U.S. valuation collapse. Unfortunately, the strategy of seeking refuge in moderately priced foreign markets was foiled by an unusually strong U.S. dollar, leading us to take a closer look at how moves in the USD affect investment outcomes for domestic investors.

Research Preview: Returns In A Year Of Dollar Strength

The U.S. Dollar Index (DXY) has gained 16.2% YTD, its best performance in almost 40 years. However, a strong dollar is bad for those with international investments, as returns are slashed when translated back into dollars.

U.S. Dollar—Drivers & Impacts

Most U.S. dollar drivers point to a stronger dollar: attractiveness of U.S. assets; policy differentials; real interest-rate differentials; terms of trade; weaker Yuan; and capital flows/hedging activity. Speculative positioning, however, is a negative and suggests the dollar rally might at least take a pause in the near term.

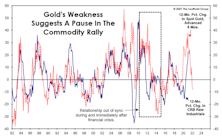

Gold: Still A Useful Dollar Hedge

A stronger U.S. dollar is “supposed” to be bearish for commodities, but it’s been a banner year for most commodities with gold among the few that are down on the year. However, keep in mind that gold tends to be a harbinger of major moves in industrial commodities, with a lead time of about six months—and its year-over-year change is now negative.

Visualizing U.S. Stock Market Dominance

It’s near the year’s mid-point and U.S. equities are doing what they’ve done nearly every year since the onset of the Great Financial Crisis: trouncing their foreign counterparts. The S&P 500’s YTD gain of 13.5% is about 500 basis points better than EAFE’s, and 800 basis points above that of the MSCI Emerging Markets Index.

U.S. Dollar—A 2018 Redux?

The price action in the DXY Index over the last year shows an uncanny resemblance to the 2017-18 period, both in duration and magnitude. Overall, we believe the dollar could strengthen in the near term, but the longer-term bearish trend remains intact.

Keep An Eye On What Your Stocks Will Buy

News that the Bureau of Labor Statistics may have undercounted the May unemployment rate by six percentage points should remind investors of the danger of taking government economic reports too seriously. Regardless of the figure, though, unemployment is no doubt near its peak for the downturn.

No Place Like Home For The 2010s

We thought we’d get a jump on all the “End of the 2010s” retrospectives you’re sure to see next month. Though not quite yet the official end of the decade, the changing of the “tens” digit definitely has a certain gravitas to it.

Is A Strengthening Dollar A Form Of Policy Tightening?

Executive summary (for those leaving early for the holiday weekend): No.

We’ve found no reliable relationship between swings in the U.S. Dollar and subsequent variations in U.S. economic growth.

Oil And The Dollar At New Highs: Is Something About To Give?

Crude oil and the U.S. Dollar Index accomplished a relatively rare feat by moving to simultaneous six-month highs earlier this week (Chart 1).

1999 Redux

As the market rebound has extended, we’ve noted its striking similarities with the rally of 1999—one that might have been the most speculative in U.S. history.

1987 Parallels (Part 2)

At the risk of yelling “fire” in a crowded theater, we present a few parallels between recent action and the year leading up to the October 1987 crash.

A Crude Catalyst?

The great mystery behind the trade-weighted dollar’s nearly-10% YTD decline is that it’s failed to fuel further gains (or any gains) in commodity prices in 2017.

Grappling With A Strong U.S. Dollar Outlook

Profitable investing overseas requires not one, but two, successful decisions: 1) select an outperforming asset class; and, 2) be in a currency that provides a favorable foreign exchange impact.

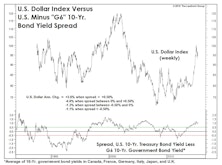

Global Configuration Of Bond Yields Supports Continued Bullish Dollar Stance

Contrary opinion theory is a valuable tool to investors, but today there are so many self-described contrarians that we sometimes struggle to identify what’s “consensus” and what’s “contrary.”

America’s Already First...

Thanks to the U.S. dollar’s recent spike, foreign equities in dollar terms declined during November while the U.S. markets were celebrating a Trump victory. Thirty-nine of the 49 MSCI country indexes are in bear market territory from the perspective of a dollar-based investor.

The Fed’s Capitulation To The Dovish Side— A Win-Win For EM & U.S.

We have mentioned a number of times that China had experienced a very unpleasant “second-hand” tightening due to its peg to the dollar. Its trade competitiveness has suffered tremendously. With a weaker dollar the Chinese Yuan can re-gain some of its competitiveness while maintaining its peg to the dollar. A rare win-win in today’s convoluted world of finance.

What’s Driving EM Currency Weakness?

A strong dollar and low commodity prices are major forces dragging down EM currencies across the board.

What’s Next For The Dollar?

The U.S. Dollar Index has recovered about half the losses from a two-month, -7% setback from the 12-year peak it established in March.

Navigating The First Rate Hike

Our current view is the lift-off will be December or later. Assuming inflation will pick up and the Fed hikes the rate by the end of 2015, stocks will perform relatively well, with international stocks a better bet than U.S. stocks.

A Few Thoughts (And A Lot Of Charts) On The Oil Collapse

Has the recent collapse in crude oil prices presented us with a good opportunity for an outright commodity investment? No. Energy stocks aren’t on our radar screen either.

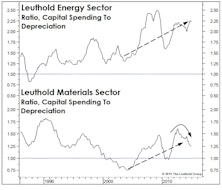

Capex, Capacity And The Dollar

We’ve been highlighting the overinvestment (or malinvestment) risks in commodity-oriented equity sectors for the past three years, but we certainly did not foresee those risks exploding the way they have in the oil market over the last seven months.

Can The Dollar Save Small Caps?

The dollar’s moonshot in recent months has resuscitated a stock market leadership argument we haven’t heard for a long time.

The Dollar And Foreign Equities

Xenophobia continues to be a handsomely rewarded trait for U.S.-based equity investors, with the MSCI World Ex USA Index down 3.8% YTD through December 3rd—and now (incredibly) unchanged from its May 2011 high. Comparable period gains for the S&P 500 are +12.2% YTD and +50% from spring 2011 highs.

Inflation & The Dollar

Are U.S. markets for labor and capital actually getting tight?

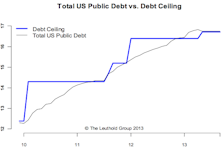

Debt Ceiling—Weakness Before But Strength After Resolution

A look at prior debt ceiling debates and patterns around resolution dates gives no surprises: markets are weaker in the two weeks before but stronger in the month after a resolution is reached.

The Dollar: Upside Limited In The Near Term

A closer look at the dollar’s two main counterparts, the euro and the yen, reveals a regime shift in both cases, but for different reasons.

Implications Of The End Of Negative Real Yield

The 10-year real yield turned positive at the end of 2012 and has stayed there. We expect higher interest rates, a stronger dollar, and lower gold prices in the next twelve months.

Bulls, Bears & The Buck

Our latest testing indicates that relative dollar stability provides the best backdrop for stocks.

The Bond Bubble Is Beginning To Deflate… Is This Cheap Money Era Ending?

An orderly decline of the dollar is not necessarily a big concern. On the other hand, a sudden collapse of the dollar, in conjunction with spiking U.S. interest rates, would be a terrible thing. So far this has not been the case.

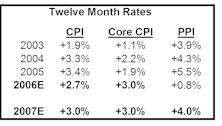

Mild Inflation, But No Deflation In 2010

We are maintaining our 2010 CPI estimate of +1.2%. (Core CPI +0.9%.)

Year End Twelve Month CPI Deflation Reading Unlikely

Looking ahead to 2011, we are keeping a close eye on Housing, Food and Wages, which all could be bottoming out.

Portraits Of Declining Inflation

Jim Floyd and Steve Leuthold believe that U.S. consumer price inflation has peaked and is headed for the +3% level by mid-2009. With current headline inflation running at +5.4%, that implies there is plenty of disinflation in the pipeline.

2008: Less Than Great

Yes, it is thermal pollution time again. It’s the new year when prognosticators and investment pundits produce large volumes of hot air, probably contributing to global warming.

Long Term Bullish Case: Dollar Versus The Euro

Thanks to weak dollar, foreigners may be buying up Florida vacation homes. The U.S. is now on sale! Making the long term bullish case for a dollar rally against the euro.

VLT Momentum On U.S. Currency...Applications (And Implications) For The Weak Dollar

Quite simply, VLT (which stands for Very Long Term) is a momentum oscillator which works best as a buy signal. Some market technicians have also suggested that VLT Momentum back-tests well as a currency indicator.

View From The North Country

2007 half time report. Revisiting our original 2007 projections with some current modifications. Outlook for stock market, interest rates, inflation, profits, economy, the deficits, the U.S. dollar and gold.

Inflation Is A Potential Threat

Inflation prospects are especially unclear. While many inflation gauges seem to be slowing, the threat of an inflation flare-up remains.

.jpg?fit=fillmax&w=222&bg=FFFFFF)

.jpg?fit=fillmax&w=222&bg=FFFFFF)

.jpg?fit=fillmax&w=222&bg=FFFFFF)

.jpg?fit=fillmax&w=222&bg=FFFFFF)

.png?fit=fillmax&w=222&bg=FFFFFF)