Bull Markets

Unfinished Business

Our tongue-in-cheek celebration of the bull market’s second birthday in late March looks premature. But the “Terrible Twos” we warned about have erupted in full force.

What If It’s Just A “Median” Bull?

Last spring and summer, we were incorrectly skeptical that a new bull had been born only five weeks after the death of oldest bull ever. But be careful with labels. Just as the “bear market” mindset caused us to overplay our hand last spring, equity bulls should not assume the current bull will look anything like the decade-long affairs we’ve seen twice in the last 30 years.

Passive’s “Placid Pandemic Performance”

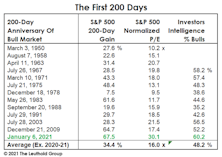

The 200-day “report card” for this bull market shows the best initial-performance gain of all postwar bulls, but it’s come at a price. Investor sentiment is above levels seen at the same point of past bull markets… and there are the valuations.

A Bounce Without “Oomph”

One would think that one of the most explosive market rallies of all time would trip-off all the traditional “breadth thrust” signals, or maybe even invent a few of its own. Sorry, no luck.

Stock Market Observations

Economic and momentum considerations have kept us mostly aboard this bull for much longer than our value-seeking inner selves would have otherwise allowed.

A Subdued 8th Birthday Celebration

The hoopla falls short of that which surrounded birthdays #3-#7; based on the flood of assets into passive stock funds, it appears complacency has set in. Current bull close to becoming longest in history.

Putting “Our Spin” On The Positive Spin

Bull markets seem to create their own moods that lead to fundamental developments being viewed in a mostly favorable light.

A Semi-Annual Checkup!

Call off the mortician, and bring on the pediatrician for the bull market’s 7 1/2-year checkup this month.

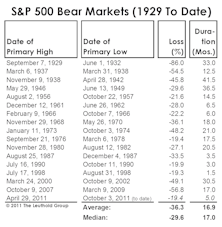

TIME: The Hidden Market Risk?

Is there a statistical relationship between the height scaled by a given bull market and its subsequent decline? That correlation is in fact pretty tenuous, we’ve found.

The Bull In Historical Context

The cyclical bull market is approaching its fifth birthday. Should you be nervous? Yes, but not so much because of its age.

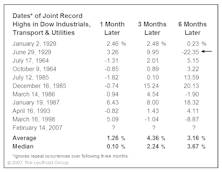

New Highs, And Then What?

We are in clear view of the “Twin Peaks” S&P 500 highs of the last decade and these should be eclipsed by mid-year. But when the S&P 500 is adjusted for inflation or denominated in Swiss Francs or Gold these highs may prove elusive.

Ringing In The New Year On A Wide Range Of Topics

Did we just get a Technical “all clear” sign? Is the trading day getting you down? What about corporate earnings, or sovereign debt and the stock market?

Will Public Buying "Drive" New Market Highs?

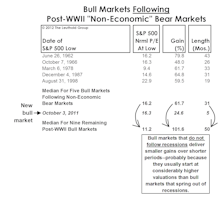

U.S. focused equity mutual funds see continued net outflows. A look back at mutual fund flows during past bull markets answers whether public participation is required to reach new stock market highs….And does a bigger Bear market equate to a bigger Bull market recovery?

Ain’t Nobody Happy

Despite the big October rebound, Doug Ramsey examines various market players and finds that dissatisfaction with recent market moves may proliferate among all but a select few.

Major Trend Index (MTI) Goes Negative: Get Defensive

Major Trend Index fell to Negative at beginning of August. Assumption is that we are now in the beginning of a cyclical bear market that may produce a 20%-25% loss within the next six months or so.

The Dreaded ‘Aha’ Moment

One of the great contrary trades in recent memory may well have been the Consumer Discretionary stocks during the last recession and early in the recovery. The consumer had been written off, but these stocks have been the clear market leader. It looks, however, like the move may be running out of steam.

Bull Market Milestones: How the Current Bull Stacks Up to Past Cycles

This month’s “Of Special Interest” examines the characteristics of past bull market recoveries. Using a variety of historical comparisons, the current recovery is put into some perspective. The majority of these comparisons seem to indicate the current recovery still has a ways to go.

Another Market Milestone

It is sobering to consider that an historic, 13-month market stampede (one now exceeding 75%) has done nothing more than restore the market to levels first seen twelve years ago.

Symptoms of a Maturing Bull Market—Assessing Potential Remaining Upside

In this month’s “Of Special Interest”, Eric and Doug put the current market in historical context. They use a variety of factors to assess the potential for further upside.

Breadth & Leadership: Bull Markets Rarely (S)Top On A Dime

Market breadth moved down in tandem with stock market indices, but is not showing any divergences. All advance/decline lines were making new highs just before the downturn, and bull markets do not end with advance/decline data posting new highs.

Stock Market Recovery….Typical In Duration, But Maybe Not In Terms Of Performance

Based on post WWII stock market recoveries, the current recovery could have some more upside (12% possibly).

Third Year Of Bull Market...Now Well Beyond Range Of Typical Bull Market Cycle Peaks

A comparison of the performance of the current stock market recovery to the monthly performance averages of past recoveries (1900 to date).

Third Year Of Bull Market...Now Well Beyond Range Of Typical Bull Market Cycle Peaks

Comparison the performance of the current stock market recovery to the monthly performance averages of past recoveries (1900 to date).

Third Year Of Bull Market...Assessing The Current Cycle From A Historical Perspective

A comparison of the performance of the current stock market recovery to the monthly performance averages of past recoveries (1900 to date).

Third Year Of Bull Market...Assessing The Current Cycle From Several Perspectives

A comparison of the performance of the current stock market recovery to the monthly performance averages of past recoveries (1900 to date and post-WWII era).

View From The North Country

Steve’s assessment of the current bullish and bearish factors. Also, Leuthold’s recent discussion of secular bear markets, sparked some debate among readers.

Getting Later In The Game For The Bull Run

Getting late in the game for the bull run. This is no longer a young bull market, but we continue to believe the market can still move higher from here.

The Certainty Of Uncertainty

Uncertainty in Iraq, terrorist threats, rising inflation, and higher interest rates (and Fed tightening) have taken center stage against a backdrop of impressive corporate earnings momentum and economic recovery.

Following The Script?

Yes September is most frequent month to produce declines, but average loss has been only a paltry 1.3%. Also, Septembers following bear market lows (like this year) actually produced strong performance.

View From The North Country

Stage is set for market’s next advance, breaking out of its two month consolidation.

View From The North Country

“View From The North Country” this month highlights several prior periods of “scary” market environments. In retrospect, all provided excellent buying opportunities.

The Year That Was

Remain bullish on the stock market, but don’t expect Main Street to be a major stock market factor in 2003. Today’s bull market expectations for the DJIA, S&P, and NASDAQ.

What I Worry About

Today’s great bull market has broken most past behavioral guidelines and precedents. It’s a different animal and could terminate as most manias do...with little forewarning and a waterfall decline.

Goldilocks Forever?

The squeeze is on. Lack of corporate pricing power, higher borrowing costs, rising labor costs and the higher dollar will eventually squeeze profit margins. Look out for earnings shortfalls, while analysts catch up to a change in trend.

How This Bull Market Stacks Up

The May issue of this publication featured a month-by-month comparison of all bull markets in this century. Per reader request, we’ve updated the comparison.

Bull Market Dynamics, Inflation Watch & Mutual Fund Mania

An updated graphic and statistical comparison of the current bull market with bull markets of the past. It still appears the current inflation complacency will be upset in coming months. The public is clearly stampeding back into the equity arena, to a large degree via mutual funds.

Comparing the Bulls

All bull markets since 1896 are examined and compared with the current specimen in terms of cumulative month by month gains. In terms of dynamics, this is an exceptional market, but hardly unprecedented. Also, all the long sustained uninterrupted uptrends of the past (like those in the 1950’s) are examined. Is this another one of those? We don’t think so. The current specimen has gone too far too fast.

Inside the Stock Market

The market is again exploding on the upside, about to make a new high. Twenty-three years of on-line market experience provides no operational guidelines for a market like this, even though the amplitude of the move and the volume relative to shares listed is not unprecedented.