Cyclicals

Growth vs. Value vs. Cyclicals

Both Growth and Value Small-Cap style boxes gained 10% in January’s rally. However, SC Growth remains well in the rearview mirror since its relative strength peak in September 2020: Small Cap Growth +8% versus Small Cap Value +60%.

Seasonal Nightmare Ending?

We’ve reminded dejected readers throughout 2022 that this year was statistically “cursed” from the onset. It’s a year ending in “2” and a Shmita year on the Jewish calendar, both of which have been associated with far below average stock market returns. More importantly, it’s a midterm election year, traditionally the weakest of the four-year cycle.

Podcast #23 - Investors Face Disparate Choices

Perusing current equity-investment possibilities highlights a diverse set of choices. Focusing on only two primary attributes—relative price and relative earnings—illustrates considerable diversity among the major investment styles.

Small Cap Catch-Up?

The big jump in Small Caps over the last two weeks has entirely reversed the segment’s summer underperformance and has technicians feverish about another “breath thrust.” Technically, it’s impressive, but we are more intrigued by the fundamental potential for continued Small Cap (and Mid Cap) outperformance.

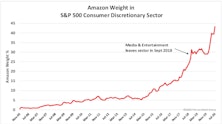

Consumer Discretionary: Neither Fish Nor Fowl

The combination of rebounding economic activity and a surging (peaking?) enchantment with mega cap growth stocks is pressing investors to make an important tactical call: whether to take profits in some highfliers and shift assets to sectors with more cyclical exposure and better valuations.

Research Preview: Not Your Parents’ “Discretionary”

The combination of rebounding economic activity and a surging enchantment with mega-cap growth stocks is pressing investors to make an important tactical call: whether or not to exit some highfliers and shift assets to sectors with more cyclical exposure.

The Rate Hike Carnage Is All Around Us

Taking a cue from the White House, today’s market pundits seem more prone to declarative, unsubstantiated statements than we can ever remember.

The Many Faces Of Mo

Momentum is one of the most widely accepted alpha-generating factors, used by quantitative and fundamental managers alike. Its biggest drawback, however, is high turnover. Herein we explore momentum from the perspective of sector weights.

A Harbor In The Tempest

Our Major Trend Index (MTI) recently fell from “positive” toward stocks to a “neutral” reading, leading us to trim bullish equity positions in our tactical portfolios.

Cyclicals: Tired Of Surprises?

The tone of global economic reports in the last four months has turned decisively up, sending Citi’s Global Economic Surprise Index to the highest level since mid-2010

Has The Hook Been Set?

Two months ago, we suggested a short-term bounce in oil might prove to be the fundamental “hook” that would rationalize a bear market rally. We thought a bounce to $45 might do the trick—and oil futures essentially cooperated, reaching $41.90 on March 22nd.

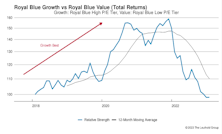

Growth vs Value vs Cyclicals

Signs of a leadership change are starting to spring up between Growth and Value. Since mid-2015, Mid and Small Cap Value stocks have outperformed Growth.

Where’s The Profit Leverage?

Industrial commodity prices and the latest ISM figures both point to a stabilization in the manufacturing sector following a two-year deceleration. Expectations for this year’s earnings have turned more optimistic as a result, but are the hopes warranted?

Growth vs Value vs Cyclicals

Small Cap Growth stocks have gotten off to a rotten start in 2016—down almost 12%. On a relative basis, the segment has also been lagging Small Cap Value—underperforming by 9% since last July.

Growth vs Value vs Cyclicals

Growth Edges Out Value As Stocks Rebound

The EM "Trap"

Growth / Value / Cyclicals

Despite the down market, Large Cap Growth expanded its YTD outperformance over Value—now almost 11%.

Growth/Value/Cyclicals

Growth Showing No Mercy To Value

Summer Trouble?

New late-June highs in NASDAQ, Small Caps, and key Financial groups weren’t enough to stem the past few weeks’ slide in the Major Trend Index, which has landed back in its neutral zone (1.01 reading).

Growth vs Value vs Cyclicals

First Half Of 2015 All About Growth

It’s Getting Late For the Early Cyclicals

Our “Early Cyclicals” composite continues to perform so well—and at such a late stage in the market cycle—that we should probably consider changing its name. This group, which consists of retail, housing, and auto-related industries, is up 29% in the last eight months after stalling out for the first three quarters of 2014. Its “Late Cyclical” counterpart is up just +5% over the same time frame.

Growth, Value, Cyclicals

Small Cap Growth stocks were the clear outperformers in May, up almost 4%. Growth stocks are still in favor when comparing YTD figures, with the performance gap especially prevalent in the Small and Large Cap spaces.

Growth, Value, Cyclicals

Value stocks, recent underachievers, regained some lost ground in April. Large Cap Value was the month’s big winner—helped in large part by rallying energy firms. Large Cap Growth still leads YTD by more than 5%.

Charts That Challenge Us…

While our disciplines continue to turn up enough bullish evidence to keep us cautiously positive toward stocks, we are seeing troubling signs by cyclicals (especially the Transports) and junk bonds.

Growth, Value, Cyclicals

Growth Continues Run In Q1

Growth, Value, Cyclicals

Growth Stocks Dominating Value

New Laggards On The Radar Screen

Transports now find themselves in a three-month RS downtrend; it’s too early to tell if this is an important message. Leading up to 14 of the last 16 bull market tops, Transports underperformed for a six to 12-month period prior to the final bull market high.

Growth/Value/Cyclicals

Momentum Continues For Growth Stocks

Growth, Value, Cyclicals

Growth Strong In Second Half Of 2014

Sector Margin Trends

The S&P 500 record median profit margin of 10.3% is now almost a full percentage point above the last cycle’s peak of 9.4% (second quarter of 2007). Trends across S&P sectors are not as uniform as one might expect, though, with only half of the ten sectors last quarter at profitability levels that exceeded their 2001-2007 expansion highs.

Growth/Value/Cyclicals

Growth Stocks Better In November

Growth vs Value vs Cyclicals

Large Cap Value Left Out Of October Surge

Growth/Value/Cyclicals

Growth Stocks Better In Rough September

Growth/Value/Cyclicals

Large Cap Growth has had an impressive advantage over Large Cap Value in six of the past seven years but that trend is reversing in 2014.

Growth/Value/Cyclicals

Growth And Value Go Down Together

Growth/Value/Cyclicals

Value strong again in Q2.

Growth/Value/Cyclicals

Growth outperformed Value in all market cap subsets: Large Cap, Mid Cap, and Small Cap. It also snapped a five month losing streak with Cyclicals. Despite the reversal, Growth is still lagging YTD, and is extremely undervalued compared to Value.

Growth/Value/Cyclicals

In April, Large Cap Value widened its YTD outperformance over Large Growth to 730 bps.

Growth/Value/Cyclicals

Growth Takes It On The Chin In March.

The Bull Market Turns Five

The post-2009 stock market upswing now qualifies as only the sixth cyclical bull market since 1900 to last five years or more. But only three of the previous five-year-old bulls lived to see a sixth birthday.

.jpg?fit=fillmax&w=222&bg=FFFFFF)