Growth Vs. Value

Masquerade Party

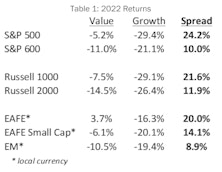

Style investors recently witnessed a rare event when, on February 13th, the P/E ratio of the S&P 500 Growth Index fell below that of the S&P 500 Value Index. At first glance, it is tempting to attribute this valuation flip-flop to the 2022 bear market, which saw Value outperform Growth by a whopping 24.2%. However, the bear-induced collapse of Growth stock prices in 2022 only served to return the P/E spread to a level just below its historical median of 5.1, meaning that the final move toward parity was caused by a force outside the market itself. That “something else” was the S&P 500 style reconstitution that occurs annually on the third Friday of December.

Weight Watcher Update—Still Like Value Sectors

While the valuation gap between Growth and Value sectors was compelling just a couple of years ago, it has closed drastically the last twelve months. Our analysis shows that Value sectors (Energy, Industrials) are still more favorable than Growth sectors (IT, Health Care).

Three Themes To Watch

The China-reopening theme is alive and well, which will likely support cyclical outperformance. The disinflation trade is at a crossroads. Value/Growth started to decouple from interest rates.

Research Preview: I Own What?!

S&P rebalanced its style indexes in December, and the shuffle caused substantial turnover. The Value index now includes a sizeable swath of mega-cap tech companies, and this changing membership significantly affects the relative valuation metrics that defined those styles.

Is Value Still A Value?

Deflating valuations in the Technology and Innovation space produced ghastly results for growth investors in 2022, with the S&P 500 Growth index experiencing an agonizing 29.4% loss. Meanwhile, last year’s bear market was no more than a mild irritation for value investors as the S&P 500 Value index lost just 5.2%. The collapse in exuberantly priced growth stocks produced a 24.2% return spread between the value and growth styles, which goes into the record books as the second biggest annual win for value since 1975.

Additional Factors

The six-week rally that started mid-June featured advances from AAPL (+25%), AMZN (+30%), and TSLA (+39%), which accounted for one-fourth of the S&P 500’s gain. Despite the recent preference for Value, a spike in interest rates, and the bear market, the index’s concentration in the top-five firms is still near it’s all-time high set in August 2020.

The Mysterious Affair of Style Returns

Mystery writers are fond of creating misdirection by introducing multiple eyewitnesses that each describe the crime differently. This plot device confuses the storyline until a clever detective comes forward to unravel the conflicting evidence and solve the mystery.

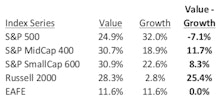

This scenario played out in style returns for 2021, as shown in Table. Our first witness is a large cap manager who tracks the S&P 500 and reports another banner year for Growth, its seventh win in the last ten years. Our second observer is a small cap manager who watches the broader market and tells of Value’s excellent year. Meanwhile, our third bystander is an international manager tracking EAFE, who reports seeing a whole lotta’ nothing in the style derby last year. In this study, we channel our inner Hercule Poirot to determine what, in fact, did happen across domestic style returns in 2021.

Research Preview: A Playground Scuffle Between Value And Growth

It is a scene easy to imagine: Two children on the playground arguing about who’s the top dog. This schoolyard scuffle played out in 2021 between the Value and Growth styles, with each claiming bragging rights from their own perspective.

Speculating In “The Nebs”

One measure of a bubbly bull market is the degree of speculative fervor embedded in the prices of companies with nebulous, indeterminate, or even nonexistent intrinsic values. Since the bear market low in March 2020, speculative manias have evolved in a menagerie of asset classes including Innovators & Disruptors, SPACs, meme stocks, crypto currencies, and NFTs. Based on the breadth of valuation extremes across numerous and diverse assets, this bull market may rank second to none.

Digging Out Of The Red

An unprecedented number of companies are still deep in the red, even while the economy is shrugging off the impact of the pandemic. Small-cap growth companies are showing no sign of a quick recovery.

Schrödinger’s Style Box

The performance derby between actively managed portfolios and passive benchmarks is strongly influenced by market conditions. Active manager success rates are cyclical, but not random, and are driven by slippage created from style, size, and weighting considerations that result from the imperfect slotting of active portfolios into single style boxes. Moreover, this slippage can be defined and measured, and shows a clear correlation with relative return spreads between benchmarks and their opposite boxes.

Valuation Extremes: Here Be Dragons

Top decile valuations are often the result of unduly positive investor sentiment that leads to inflated multiples. Bullishness comes in varying strengths: optimism, enthusiasm, exuberance, and, at the extreme, the mania of crowds. Because bullishness manifests itself in aggressive valuations for speculative companies, we believe the prices being applied to such companies - for which intrinsic value is dependent on a future that looks significantly different than today - are an excellent measure of investor sentiment. In that spirit, we examined past cycles of extreme valuations with the goal of understanding how they relate to investor sentiment and what they might tell us about market conditions and relative returns.

Research Preview: A Tale Of Two Tails

Top decile valuations, such as those in place today, are usually the result of excessively positive investor sentiment that leads to inflated multiples. Bullishness comes in varying strengths: optimism, enthusiasm, exuberance, and, at the extreme, the mania of crowds. Leuthold research typically tracks valuation sentiment by examining median P/E ratios, but in this study, we are taking the opposite tack. Rather than looking at medians, we are focusing on the outliers in each tail of the valuation distribution.

Kindred Spirits: Financials And The Value Style

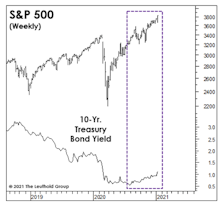

Investors looking for the long-awaited rebound in the Value style point to the potential for rising interest rates as a possible driver of style rotation. Higher rates would benefit many Financial companies, a sector closely linked to the Value style. In fact, many commentators believe that the Value style cannot experience a major run without the participation of Financials. We launched a research effort to examine the link between Financials and Value, seeking to understand whether there is truth in this old saw, or whether this connection is more properly classified as market folklore.

Research Preview: Are Financials And Value “Best Friends Forever?”

Investors looking for the long-awaited rebound in the Value style point to the potential for rising interest rates as a possible driver of style rotation. Higher rates would benefit many Financial companies—a sector closely linked to the Value style. In fact, numerous commentators believe that Value cannot experience a major run without the participation of Financials.

Inaugurations And The Stock Market

Presidents and the popular press have become obsessed with performance over the “first 100 days” in office. That prompted us to see if there have been any persistent stock market effects related to this 100-day window. There are many ways to slice the data, and the more we sliced it, the fewer the observations.

Rising Rates And Rising Stock Prices?

Often, what market pundits like to pass off as bold, contrarian forecasts are merely rationalizations and extrapolations of trends that have already been in place for some time.

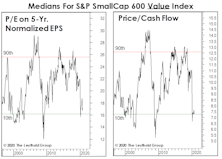

Small Value Or Small Growth? Yes!

If there’s an emerging bubble in Growth stock investing, it certainly doesn’t apply to Small Caps. The “usual” premium for Growth over Value within the Small Cap space is nonexistent—both segments look historically cheap.

Growth Wherever You Find It

Growth investing is in the midst of a spectacular run this year, extending its decade-long dominance over the Value style. Chart 1 depicts the Growth / Value relationship over the last 25 years through July 31st, with key turning points marked by vertical lines.

Research Preview: Growth, Pure And Simple

Growth investing is in the midst of a record run this year, extending its decade-long dominance over the Value style.

The Growth Style’s Twin Peaks

The strong market rebound in the second quarter lifted the relative return of Growth vs. Value to an all-time high by the end of June. Chart 1 reveals that the cumulative S&P 500 Growth / Value return spread hit a new record last month, surpassing the previous high reached at the end of the Tech bubble in June 2000.

Money Losers Among Small-Cap Growth

Late last year, we presented data showing that profitability has become more elusive for small companies despite a record-long period of economic expansion. We discussed the potential causes underlying this phenomenon.

Box Jumpers Beware!

Style rotation! Regime change! Market action of the first two weeks of September coaxed the few remaining Small Cap Value managers off ledges from New York to San Francisco.

1999 Redux

As the market rebound has extended, we’ve noted its striking similarities with the rally of 1999—one that might have been the most speculative in U.S. history.

Partying Like It’s 1998-99

We thought Jerome Powell’s “Christmas Capitulation” would be tough to beat, but he accomplished that two days ago with what could be called his “Spring Surrender.” That, in turn, has rekindled hopes of a stock market melt-up along the lines of 1998-99, which, as old-timers will remember, followed a late-cycle correction that was nearly identical to the one seen last year.

Try This On For Size

Today’s market is barbelled regarding company size, with the mega-cap Tech stocks and the S&P 600 Small Cap index both outperforming the middle of the S&P 500.

Value Style’s 100-Year Flood

Value is the philosophical cornerstone of many legendary portfolio managers and is widely recognized as one of the most robust quantitative investment factors. Yet, despite its compelling conceptual merits and long-term record of superior returns, recent years’ underperformance of Value has lasted long enough to weigh on even 10-year performance records.

Growth: Too Much of a Good Thing?

Growth has trounced Value over the past year, continuing a decade-long trend of outperformance...

Valuation-Based Country Selection/Rotation

Despite cyclicality, over the longer term, investing in lower valuation countries ekes out better performance in an EM portfolio, and Dividend Yield showed the most consistency in terms of value factor effectiveness.

Dynamic Factor Investing: A Study In Value

Investment factors experience performance cycles just like every other asset and index. The Value factor is robust across definitions, as all eight versions produced positive excess returns under long/short and long-only methodologies.

Same Ponds, Different Fish?

The impact of atypically-high current valuations has become a challenge for style-box investing. High quality, mature dividend payers have habitually resided in the Value and Blend boxes, but investors have bid up those valuations as they look for alternatives to low bond yields.

Growth vs Value vs Cyclicals

Signs of a leadership change are starting to spring up between Growth and Value. Since mid-2015, Mid and Small Cap Value stocks have outperformed Growth.

Growth vs Value vs Cyclicals

Small Cap Growth stocks have gotten off to a rotten start in 2016—down almost 12%. On a relative basis, the segment has also been lagging Small Cap Value—underperforming by 9% since last July.

Navigating The First Rate Hike

Our current view is the lift-off will be December or later. Assuming inflation will pick up and the Fed hikes the rate by the end of 2015, stocks will perform relatively well, with international stocks a better bet than U.S. stocks.

Mythbusters: Style Performance During Bear Markets

Will Rogers said, “It isn’t what we don’t know that gives us trouble, but what we know that ain’t so.”

Why We Are Buying Big Cap Growth Stocks Now

Big cap growth stocks appear to be in the early stages of regaining leadership from the “tired” cyclicals and “overvalued” value stocks.

In Search of Blue Chip Growth Stocks

Growth stocks have been out of favor over the past 3-4 year, but look poised to regain leadership over the next 6-12 months.

Did Your Stocks Make Money In April?

A glance at the popular market averages made April look like a pretty good month in the stock market. But if your equity performance in April matched those numbers, you must have had a well-oiled portfolio of deep cyclicals.

August Insights

Secondary stocks’ August performance, growth vs. cyclical and growth vs. value performance, S&P and DIJA historical valuations and the Royal Blue Index.

Adding To “Undervalued & Unloved” Stocks

This month we added three new stocks from Jim Floyd’s “Undervalued & Unloved” screening work, boosting our current commitment to value stocks to 16% of portfolio assets. We now believe Value's downtrend has reversed and this view seems to be confirmed by the relative strength line.

_0.jpg?fit=fillmax&w=222&bg=FFFFFF)

.jpg?fit=fillmax&w=222&bg=FFFFFF)

.jpg?fit=fillmax&w=222&bg=FFFFFF)