Margins

Marg-flation

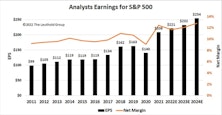

The 2022 bear market will be remembered as a year when collapsing growth stock valuations and rising interest rates doomed almost every asset class to return purgatory. Hopes for avoiding a second down year rest with a potential top in interest rates and solid earnings underpinning the stock market. Wall Street strategists have a year-end 2023 price target of just over 4,000 for the S&P 500, a few percentage points of upside from today but hardly reason to toast a prosperous new year.

Third Quarter 2022 Earnings Waterfall

This earnings season has not been free of concern, and profit margins are clearly weakening from last year’s highs. Our earnings waterfall template highlights several themes coming out of third quarter results.

Research Preview: Inflation And Margins

A new study looking at the relationship between inflation and profit margins is introduced. The goal is to understand how the latest margin peak was reached in mid-2021 and what impact inflation might have on margin forecasts underlying next year’s earnings estimates. Full report will be sent mid-month.

Earnings Expectations: The Bear’s Other Shoe

To paraphrase that great market historian Leo Tolstoy, “each bear market is unhappy in its own way.” Recession, interest rates, valuation bubbles, inflation, war, credit cycles, oil prices, manias & panics: the tipping point that triggers each bear market is always different. However, bearish forces ultimately manifest themselves in just two ways; declining earnings and/or declining valuations. June’s Of Special Interest report detailed how the current bear market has been fueled entirely by collapsing valuations, with the largest P/E compressions occurring in companies with the highest starting valuations.

Research Preview: The Impact Of Falling Estimates

The 2022 bear market has been driven entirely by a collapse in P/E ratios. Last month, we noted that the other potential driver of market declines—falling earnings—had yet to raise its ugly head. Now we examine past episodes to consider how the stock market might react when the “other shoe” (EPS) drops.

From Tighter Lending To Margin Pressure

Intuitively, what happens in the credit market is usually echoed by lending activities. This was a key concern when the credit market joined the stock-market rout in May. Another big leg up in real interest costs, through higher rates and/or lower growth, will surely create more headwinds for profit margins.

Signs Of Margin Pressure Ahead

Banks’ lending standards for C&I loans (typically to large businesses) tightened quite a bit in Q1, which bodes ill for both investment and overall economic growth going forward.

What Can Margins Do For An Encore?

A massive drop in corporate tax payments lifted the third quarter NIPA profit margin back to the 10% level for the first time four years. But while we try not to always view the glass as half empty, we find it troubling that margins remain well-below their 2012 highs (10.6%) in spite of this one-time windfall.

Sector Margin Checkup

U.S. companies hoping for a reduction in the corporate tax rate are not exactly doing a convincing job of demonstrating “need.”

Profit Margins At The Sector Level

All ten of the S&P 500 sectors recorded a sequential increase in four-quarter trailing net profit margins. But consider where sector margins stand today relative to their 25-year medians. Eight of ten S&P 500 sectors are recording profit margins well above their long-term medians.

Earning Momentum

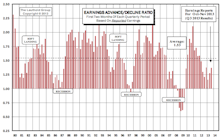

While the current ratio of 1.37 is relatively weak historically, it is still an improvement from the second months’ readings of Q2 (1.27) and Q1 (1.16).

The Mundane Truth Behind Margins

The margin expansion story of the last 20 years is a financial one, not an operating one.

Earnings Momentum - Q2 Reports Below Average But Ahead Of Q1

With all three months of Q2 earnings reports in, the 1.28 ratio is much stronger than Q1, but remains below the 1.51 historical average ratio.

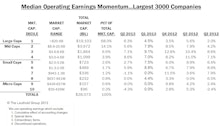

Q2 Median Company Earnings Growth Rates Vary Drastically Across Cap Size

EPS growth for Large and Mid Cap companies continues exceeding their top-line growth, but Small and Micro Cap companies saw their EPS growth rates coming in below their top-line growth rates.

Q2 Median Revenue Comparisons: Higher Growth Across All Segments

Large Cap result this month is the same as last month, but remains stronger than Q1. Smaller firms reversed course, as Mid, Small, and Micro Caps all rebounded with large sales momentum increases.

Q2 Median Company Earnings: Growth Rates Volatile But Positive In General

EPS growth rates are coming in higher than expected. While sales growth remains muted, the ability of companies to do more with less and maintain high operating margins is impressive. Margins are determined at the discretion of management and are thus sticky and unlikely to drop off significantly unless wage pressures resume and slack capacity around the globe is absorbed.

Q2 Median Revenue Comparisons: Higher Growth In Large And Mid Caps

Q2 relative to Q1 growth rates have improved for larger cap companies but deteriorated for the smaller firms.

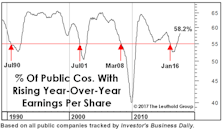

The Risks Of Record Margins…

While the big S&P companies’ EPS have held up, our earnings breadth work has not held up as well. Part of this development can be traced back to February 2011’s “Point of Recognition.”

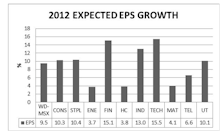

Global Perspective On 2012 Earnings, Sales, and Margins

Leuthold’s Eric Weigel dissects earnings, sales and margin expectations for the coming year.

Digging Deeper With Group Level Data

This month’s “Quantitative Strategies” section presents a preliminary look at some long term trends in Valuations and Profit Margins for specific industry groups.

.jpg?fit=fillmax&w=222&bg=FFFFFF)