A/D Line

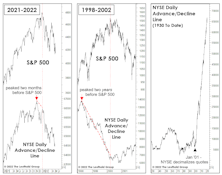

Not Dot-Com

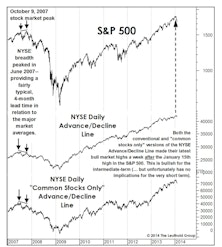

Bulls have been quick to assure us that this market “bears” no resemblance to the dot-com bust. We agree—but probably for very different reasons. Among them are the conventional breadth measures, which provided little warning of this year’s January peak. And, the initial decline off January’s top has been much broader than during the first phase of the dot-com bust.

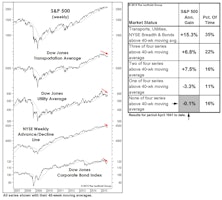

Testing The Transports

A new market high that is not confirmed by the stocks of companies that “move the goods” is a warning signal. We reviewed the Transports’ action in all years the S&P 500 accomplished a 12-month high during the month of July, like it did this year.

Weakening Foundation

Over the last few months, we’ve presented a couple of simple quantitative studies meant to encapsulate the factors driving our Major Trend Index to the brink of bear territory. The chart and table might provide the best summary yet.

Two Takes On Market Breadth

Market technicians continue to argue that a bull market peak is unlikely to form with the majority of U.S. stocks (and global ones, for that matter) still participating in the new highs of the blue chip indexes.

Penny Wise, Pound Foolish?

The Wall Street technical crowd remains mostly bullish, in large part because breadth accompanying this year’s new high has been decent. We follow the same figures and can’t dismiss their point. But pundits whose market views are heavily reliant upon the NYSE breadth figures should be aware of a strong upside bias that’s existed in the data since around 2001.

What The Market Tells Us About Fed Policy

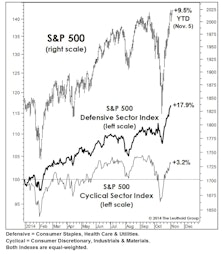

Poor performance in 2014 by two typical victims of Fed tightening—Consumer Discretionary and Small Caps—corroborated our argument that “tapering” is tightening.

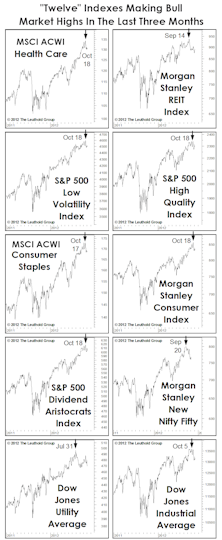

What To Make Of Market Leadership

The renewed embrace of risk hasn’t extended to the sector level. After resisting decline in late September through mid-October, defensive sectors have matched the rebound in Cyclicals, almost point for point.

Market Internals—Breadth Weakness Troubling But Not Dire

Remember that peaks in market breadth tend to lead peaks in the S&P 500 by at least a few months.

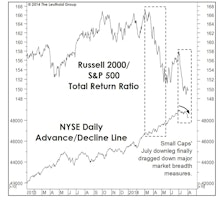

Small Cap Weakness Is Not A Market Death Knell

With Small Cap stocks falling to an 11-month RS low while the DJIA hits a new price high, many technicians point to this divergence as evidence the dangerous "distribution" period is underway. We're not so sure.

Stock Market Observations

DJIA eclipsed its year-end closing high; Dow Transports still strong; NYSE A/D Line hits all-time high.

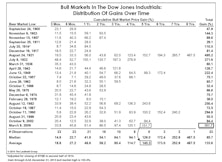

Bulling Through The History Books

The Dow Jones Industrials’ bull market gain of +150% is well ahead of the long-term median (+86%) and average (+134%), and places the 2009-to-date move as the sixth-best all time.

Too Early For The Top?

January’s new breadth highs suggest new bull market price highs are likely some time in the next several months… but they can’t rule out a painful February.

Little To Complain About

From a pure price action perspective, it’s difficult to find cracks in the bull market’s edifice.

Is The Glass “Half Full”?

A “dozen” major market measures have moved to new bull market highs in the last three months. But many of these have been the groups that do best when “risk” is “off,” and may be a reason “Ain’t Nobody Happy,” even in an up year.

Major Trend Index (MTI) Goes Negative: Get Defensive

Major Trend Index fell to Negative at beginning of August. Assumption is that we are now in the beginning of a cyclical bear market that may produce a 20%-25% loss within the next six months or so.

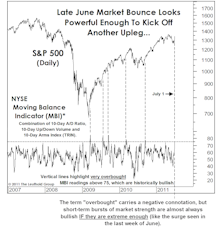

Yet Another Breadth Blastoff

Another breadth blastoff gives us reasons for optimism that our bullish predictions for the end of the year will hold.

A Thinning Of The Ranks

Market breadth has weakened considerably, which has historically been a big negative for stocks. However, the lead time between peaks in market breadth and eventual bull market peaks are long and variable.

Advance/Decline Line & Price Line Divergences Offer Guidance

Using Breadth Dynamics to assess strength of small cap stocks versus large cap stocks within various broad market sectors: Health Care, Materials, Consumer Discretionary, and Energy.

Narrowing Of Breadth Among Small Caps

Leuthold Group specialized Advance/Decline Lines indicate fading breadth among Small Caps.

Stock Market Breadth Continues To Be Impressive

Market breadth using Advance/Decline Lines looks very bullish for stocks.

For The Technicians

Examining some of the impacts that decimalization and the inclusion of financial derivatives may have on the NYSE Advance/Decline Line & ARMs Index.

Market Breadth Update

Based on the weekly Advance/Decline line, market breadth has improved considerably. This is evidence of a much stronger underlying stock market than the S&P 500 and other measures might indicate.

Market Breadth Update

Despite the market’s weakness in March, the breadth experienced some deterioration in the last half of the month.

Be A Buyer, Not A Seller

Stock selection in a recession is a different ball game! A look at some of the rules and the traps when investing during a recession. The Bullish Message Of Breadth: Demonstration of how divergences between the S&P 500 and the A/D Lines have denoted market tops and market strength.

Big Caps Hot Out Of The Starting Blocks

It’s no secret that the term “January Effect” has taken on a different meaning in recent years. Once a reference to the price bounce that underperforming small caps stocks receive as year end selling pressures dissipate, it has now been adopted by commentators to describe the unconstrained rally of large cap stocks, as the seasonal flood of cash pouring into big cap growth funds is invested

Is 1998 Like 1987?

Comparing 1987 versus 1997 and 1998 Advance/Decline lines: 1987’s actually didn’t look nearly as bad as today’s.

Octophobia? 1997 Is Not Like 1987 in Two Important Ways

Octophobia…but October 1997 is not at all like October 1987. In 1997, the Advance/Decline line has continued “in gear” with the S&P 500, whereas in 1987, the A/D line peaked out five months before August 1987’s peak.

View From the North Country

Is Warren Buffett doing some very significant selling? I think this might be the case. Leuthold Group three part series on deflation will be sent to clients in September and October. Also, the 10th Anniversary of 1987’s stock market peak: two important “then” and “now” comparisons.

What I Worry About

Today’s great bull market has broken most past behavioral guidelines and precedents. It’s a different animal and could terminate as most manias do...with little forewarning and a waterfall decline.

OCO Advance/Decline Line Update

This version of market breadth continues to present a more bearish picture than the other A/D measures.

For Technical Types

I have been employing market breadth data for 32 years, tracking and interpreting a number of variations of advance/decline calculations. Here are some of my conclusions about advance/decline studies.