Advance/Decline

Isn’t That Super?

Washed-out investor sentiment and “oversold” stock market oscillators are usually good reasons to get more invested in stocks. But in the case of super-oversold conditions, it is commonly a forewarning that another wave of selling is yet to come.

Reading The Short-Term Tea Leaves

The market’s August push was enough to lift four of the seven lagging bellwethers to new cycle highs. Among the three remaining laggards, only the Dow Jones Transports is still significantly below its high.

“Granddaddy” Tells A Lie

Based on the “granddaddy” of all technical indicators—the daily advance/decline line—we wouldn’t normally be worried that the April 30th high in the S&P 500 could be the final high of the bull market.

Technical Difficulties

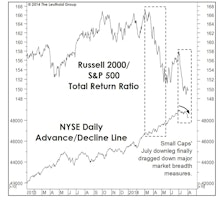

Traditional breadth measures have yet to show end-of-cycle thinning of the ranks, but some secondary measures suggest that process may be underway.

The Bulls And Bears Agree!

Yes, bulls and bears now hold their respective positions for the same reason—i.e., the U.S. economy is exceptionally strong. The stock market is accommodating this rare bipartisanship with sufficient reason to support either position.

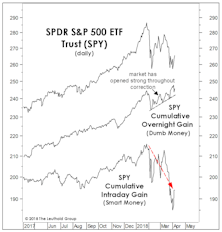

Assessing The Selling

While the January 26th bull market high illustrated none of the hallmarks of a major cyclical top, there are secondary signs that a stealthy distribution process may be underway, such as an overwhelming bias toward opening market strength followed by intraday weakness.

Change In Market Character

The Major Trend Index fell into its negative zone last week and we trimmed the already below-average net equity exposure in tactical accounts by a few more points, to a current 41-42%.

Stock Market Observations

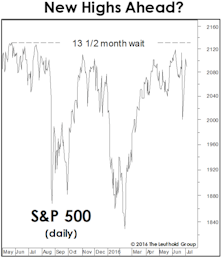

After a two-month lull, stock market momentum reasserted itself in May bringing our summer S&P 500 target of 2,600 back into focus… Meanwhile, we’ve fielded several media calls about the “FANG” stocks’ large contribution to some YTD returns—but that doesn’t diminish the new highs being made elsewhere by disparate groups… NYSE Weekly A/D Line and New Highs/Lows figures also suggest the stock market isn’t yet top-heavy enough to tip over.

Stock Market Observations

Second-half results showed the U.S. emerging from the 2015-2016 profit recession, and our early read is that the first quarter should show more of the same.

Stock Market Observations

The Major Trend Index stabilized in a moderately bullish range during the past several weeks, yet the Momentum/Breadth/Divergence category is almost the sole carrier of the bullish torch.

Stock Market Observations

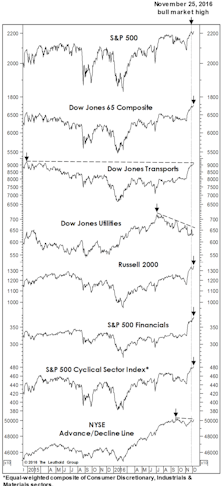

We revisit our “Red Flag Indicator” of prior bull market tops versus today. Usually most of these internal market measures will deteriorate in advance of the final bull market peak. At the latest S&P high, three of the seven leading measures had raised Red Flags, by not confirming, but two of them (DJ Transports and the NYSE A/D Line), are within just ticks of new bull market highs.

Charts: Beware Of Myopia

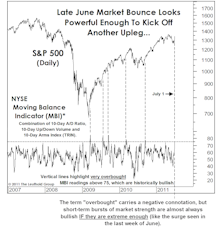

Despite a two-month stall in the blue chips, the breadth and momentum behind the market’s rally off mid-February lows remain hard to deny.

How Will It All End?

Last month we described ourselves as “long on equities, but light on conviction,” and that description still applies.

Stock Market Breadth: So Good We’re Suspicious

Market breadth measures have been so strong since the February low that we wonder whether something might be wrong with them.

Stock Market Observations

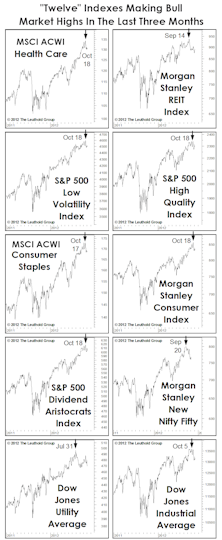

With the S&P 500 levitating near its all-time high, stock market leadership is peculiar—characterized by a flight to quality. And, despite the market’s violent bounce off February lows, there have been only four new market highs set by key indexes on our “Bull Market Top Timeline” table.

Stock Market Observations

Commentators now label this cyclical advance the “seven-year bull market,” but that won’t be semantically true until the S&P 500 closes above its May 2015 peak of 2130.82.

Weakening Foundation

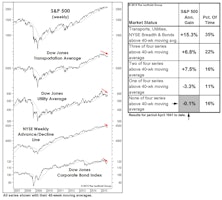

Over the last few months, we’ve presented a couple of simple quantitative studies meant to encapsulate the factors driving our Major Trend Index to the brink of bear territory. The chart and table might provide the best summary yet.

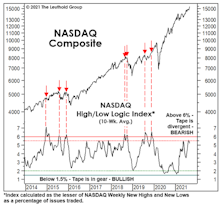

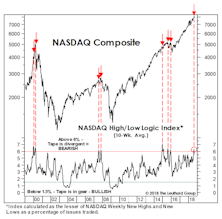

Two Takes On Market Breadth

Market technicians continue to argue that a bull market peak is unlikely to form with the majority of U.S. stocks (and global ones, for that matter) still participating in the new highs of the blue chip indexes.

Penny Wise, Pound Foolish?

The Wall Street technical crowd remains mostly bullish, in large part because breadth accompanying this year’s new high has been decent. We follow the same figures and can’t dismiss their point. But pundits whose market views are heavily reliant upon the NYSE breadth figures should be aware of a strong upside bias that’s existed in the data since around 2001.

What The Market Tells Us About Fed Policy

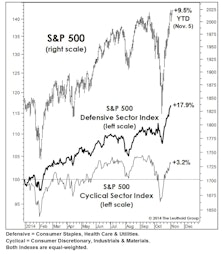

Poor performance in 2014 by two typical victims of Fed tightening—Consumer Discretionary and Small Caps—corroborated our argument that “tapering” is tightening.

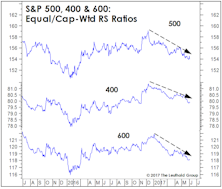

What To Make Of Market Leadership

The renewed embrace of risk hasn’t extended to the sector level. After resisting decline in late September through mid-October, defensive sectors have matched the rebound in Cyclicals, almost point for point.

Market Internals—Breadth Weakness Troubling But Not Dire

Remember that peaks in market breadth tend to lead peaks in the S&P 500 by at least a few months.

Market “Externals” Versus “Internals”

The breadth of new market highs across multiple market indexes illustrates beyond a doubt that the stock market is “externally” in gear, but some analysts contend the market is showing “internal” signs of weakness.

Little To Complain About

From a pure price action perspective, it’s difficult to find cracks in the bull market’s edifice.

“Immature” Market Behavior

Whether one considers the post-2008 upswing two bull markets or one ultimately matters only to those who (like us) enjoy cataloging such things. But labeling the 2011-2013 rally a new bull market would certainly explain some of the “immature” behavior exhibited by U.S. stocks in recent months.

Ringing In The New Year On A Wide Range Of Topics

Did we just get a Technical “all clear” sign? Is the trading day getting you down? What about corporate earnings, or sovereign debt and the stock market?

Is The Glass “Half Full”?

A “dozen” major market measures have moved to new bull market highs in the last three months. But many of these have been the groups that do best when “risk” is “off,” and may be a reason “Ain’t Nobody Happy,” even in an up year.

Yet Another Breadth Blastoff

Another breadth blastoff gives us reasons for optimism that our bullish predictions for the end of the year will hold.

A Thinning Of The Ranks

Market breadth has weakened considerably, which has historically been a big negative for stocks. However, the lead time between peaks in market breadth and eventual bull market peaks are long and variable.

Small Caps Succumbing

Why have Small Caps been outperforming Large Caps since January?

A Sudden Case Of Bad Breadth

Deteriorating stock market breadth was one of the factors contributing to the overall decline in the Major Trend Index to Negative status. An examination of the current Advance/Decline Lines shows the fade is continuing, and is particularly prevalent in the small cap indices.

Breadth Is Lagging…..But It Can Lag For a Long Time Before The Market Rolls Over

Market breadth improving, but still relatively weak. Narrowing breadth can, however, persist for a long time. There was a two year period of diverging breadth in 1998 to 1999, prior to the last bear market.

November’s Rally Accompanied By Weak Market Breadth

The market rally in November, which carried many indexes to new highs, was not as broad-based as we like to see, but Breadth did improve some later in the month.

Advance/Decline Line & Price Line Divergences Offer Guidance

Using Breadth Dynamics to assess strength of small cap stocks versus large cap stocks within various broad market sectors: Health Care, Materials, Consumer Discretionary, and Energy.

Narrowing Of Breadth Among Small Caps

Leuthold Group specialized Advance/Decline Lines indicate fading breadth among Small Caps.

Stock Market Breadth Continues To Be Impressive

Market breadth using Advance/Decline Lines looks very bullish for stocks.

For The Technicians

Examining some of the impacts that decimalization and the inclusion of financial derivatives may have on the NYSE Advance/Decline Line & ARMs Index.

Market Breadth Update

Based on the weekly Advance/Decline line, market breadth has improved considerably. This is evidence of a much stronger underlying stock market than the S&P 500 and other measures might indicate.

Market Breadth Update

Despite the market’s weakness in March, the breadth experienced some deterioration in the last half of the month.

Earnings Data Signaling Slowdown Ahead?

Earnings Momentum appears to have slipped some in Q1. Peak earnings momentum now behind us. Expect slowdown, as economy cools and cost pressures heat up.