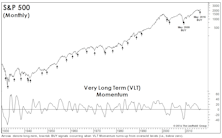

VLT

Mixed Messages From VLT

While VLT for the S&P 500 continued to trend lower in November, the DJIA calculation edged higher and triggered a new BUY signal. The message could soon get more confusing: A BUY signal for the Russell 2000 would be triggered if that index closes December above 1,813, while the S&P 500 and NASDAQ would have to climb more than 11% and 15%, respectively, to trigger a VLT BUY.

The Emerging Markets Dilemma

We’ve been either light on Emerging Market stocks or out of them altogether since early 2011, but have lately been watching for an opportune time to re-enter.

VLT = Very Lousy Timing?

In the spirit of keeping an open mind, three months ago we observed that our S&P 500 VLT Momentum measure had triggered a “moderate-risk” BUY signal with its August reading.

Another Eulogy For The Bond Bull

In the past year, big-name bond gurus have put forth various yield targets that, if exceeded, would provide definitive proof that the secular bull market in Treasury bonds begun in 1981 had finally ended.

VLT Turns Up Again??

A “moderate-risk” S&P 500 VLT BUY signal was triggered at the end of August, but it’s not all good news. Any upturn in the VLT while the indicator is in positive territory also sets up a pattern known to veteran market analysts as the “Killer Wave.”

A “Busted” Bond BUY Signal

Last October our VLT algorithm recorded a bond BUY signal—one that we said, at the time, conflicted with our outlook.

What Yield “Kills” The Secular Bond Bull?

Bond market strategists remain hell bent on identifying the key yield level on 10-year Treasuries at which one can finally declare an end to the 1981-20XX secular bond bull market.

A Mysterious Bond BUY Signal…

Sometimes we feel compelled to report findings that conflict with our outlook. And then there are the even rarer times we actually do it.

VLT Goes “Quiet”

Last year’s “low-risk” BUY signals from our Very Long Term (VLT) Momentum algorithm have proven very profitable, but enough time has elapsed that they should no longer be considered an important bullish factor.

What’s Ailing Small Caps?

While the Russell 2000 loss during the 2015-16 correction was almost double that of the S&P 500, the decline did not fully erase the P/E premium Small Caps have enjoyed since the middle of last decade. The premium might need to be entirely erased before a multi-year Small Cap leadership cycle can begin.

Not Much “Lift” From VLT “BUY”

In the June Green Book, we professed some skepticism surrounding the long-term, “low-risk” BUY signal for stocks that was triggered at the end of May by our Very Long Term (VLT) Momentum algorithm (also known as the Coppock Curve).

More Upside For Small Caps?

There was a major cyclical BUY signal (VLT Momentum) for the S&P 500 in late-May, and as of July’s close, that bullish development was reinforced by a new VLT BUY signal on the Russell 2000.

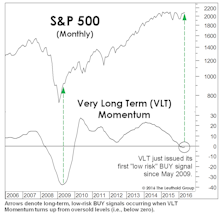

VLT Says “BUY”

Breadth underlying the 4-month upswing has been stronger than that observed during any other rally leg since 2013. Despite just a 14% correction in the S&P 500 from its peak, a new VLT “BUY” signal was triggered. Failed signals are relatively rare, the last one occurred in December 2001.

Implications Of Oversold VLT Momentum

The S&P 500 decline has yet to come close to a bear threshold, but it’s nonetheless been sufficient to drive the Very Long Term (VLT) Momentum algorithm into oversold territory for the first time since late 2009. In 16 of 21 prior cases, VLT Momentum’s initial oversold reading was a harbinger of a market that was soon to become even more oversold.

Learning From Failures?

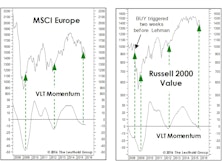

There’s an old trader’s adage which holds that “the most powerful sell signal is a failed buy signal.” Last fall we noted that European equities and Small Cap Value had triggered BUY signals on our Very Long Term (VLT) Momentum algorithm.

BUY Signals In A Topping Market?

Here’s an example of just how disparate underlying market action has become: with the S&P 500 only 2% away from a cycle high, several major U.S. and foreign market indexes have already moved into an oversold position on the basis of our Very Long Term (VLT) algorithm—with a few (including EAFE, Chart 1) actually triggering “long-term, low-risk” BUY signals in the last two months! We are not sure what to make of this action.

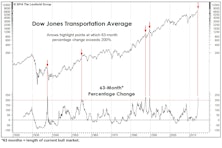

TIME: The Hidden Market Risk?

Is there a statistical relationship between the height scaled by a given bull market and its subsequent decline? That correlation is in fact pretty tenuous, we’ve found.

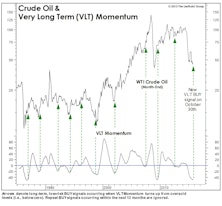

VLT Flashes A BUY On Oil

As expected, our VLT Momentum algorithm triggered a “low-risk” cyclical buy signal on crude oil in late October, only the 11th buy signal in the past 30 years. This algorithm was originally designed to identify low-risk entry points into the stock market, but we’ve found it useful with other assets as well.

A Lasting Low In Crude?

In our naïve way of measuring market moves, WTI crude oil is about 15% from its $53.27 December 31st closing price. But thanks to financial television, we’re beginning to wise up.

Oil Prices And VLT

Energy groups continue to rate poorly in our quantitative work, but change will probably be afoot in the second half.

A Few Thoughts (And A Lot Of Charts) On The Oil Collapse

Has the recent collapse in crude oil prices presented us with a good opportunity for an outright commodity investment? No. Energy stocks aren’t on our radar screen either.

“Overbought” Can Be Good Or Bad

The notion of “overbought” and “oversold” markets might be the costliest concepts ever developed by stock market technicians. The very words imply some sort of excessive condition that’s prone to naturally self-correct.

A Milestone You Might Have Missed

The fifth anniversary of the bull market was met with fanfare, but the launch of the Large Cap leadership cycle in April 2011 is receiving no attention whatsoever.

Group Scores Worked Well In 2013, What We Like For 2014

All five factor categories did well, and the best performing Attractive industries came from six different sectors and ranged from traditionally defensive to more cyclical groups.

Timing The “Taper”

The new debate over the QE “taper” erupted at the same time that a long-reliable Fed-tracking tool is telling us it’s time to ease.

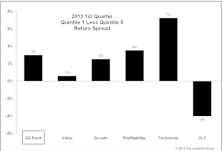

Q1 Review of Group Selection (GS) Scores

After a recent rough patch due to a multitude of factors (macro driven markets, high correlations, etc.), our domestic Group Selection (GS) Scores started seeing more consistent performance during the fall of 2012. This continued through the first quarter of this year, with the Attractive to Unattractive return spread at +3.0% year-to-date.

New Highs, And Then What?

We are in clear view of the “Twin Peaks” S&P 500 highs of the last decade and these should be eclipsed by mid-year. But when the S&P 500 is adjusted for inflation or denominated in Swiss Francs or Gold these highs may prove elusive.

An “Oversold” Market Turns Up

VLT Momentum fired long-term BUY signals at the end of July on the Russell 2000, MSCI World Index and EAFE - and more signals could be coming…

Bull Market Extension?

VLT has turned up for most market indices. Even though it is still above the zero line, history shows that this signals an extension of the bull market.

Struck Down By The "Killer Wave"

Last January we noted the appearance of a rare and dangerous technical configuration in the Dow Jones Industrials Average. Some analysts have described this topping pattern as the “Killer Wave”, and did it ever live up to that nickname in 2008.

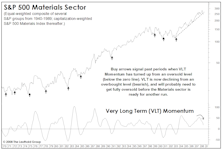

Materials: From First To Worst

Materials sector has fallen fast and hard in our GS Score rankings and is now the worst rated. Still see further downside based on valuations and technical factors. No, we do not think the underlying commodities can outperform while the stocks fall.

Client Question: VLT Buy Signals

“Given the broad declines in the stock market since October 2007, are there any particular industry groups which are beginning to look washed out enough to trigger a buy signal on the VLT work you employ in your Group Selection Scores?”

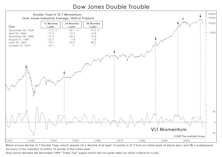

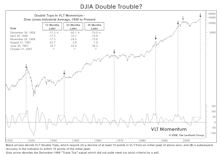

Dow Double Trouble

Our VLT (Very Long Term) Momentum algorithm—alternatively known as the Coppock Curve or “Madness of Crowds”—has just rolled over after forming a rare “double top” formation. Why has the rare VLT Double Top typically proven lethal for the stock market?

VLT Momentum On U.S. Currency...Applications (And Implications) For The Weak Dollar

Quite simply, VLT (which stands for Very Long Term) is a momentum oscillator which works best as a buy signal. Some market technicians have also suggested that VLT Momentum back-tests well as a currency indicator.

The VLT Momentum Indicators…..Third Buy Is A Charm

VLT Momentum registers another buy signal. Only in the 1930s has a similar pattern of buy signals developed. Third buy led to big gains back then.

The VLT Momentum Indicators…..New Buy Signals On S&P 500 & DJIA

VLT Momentum, a long term technical measure, recorded buy signals on S&P 500 and DJIA. This is a very reliable indicator.

De-Mystifying VLT Momentum

An explanation of VLT Momentum (The Coppock Curve); what it is and how we use it.

VLT Momentum Buy Signals...Good News For Small Cap Fans

Maybe we are too cautious about calling a turn in relative small cap performance. VLT work on Russell 2000 and Value Line now both giving buy signals.