Defensives

Earnings Expectations: The Bear’s Other Shoe

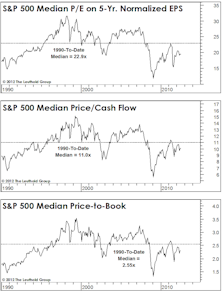

To paraphrase that great market historian Leo Tolstoy, “each bear market is unhappy in its own way.” Recession, interest rates, valuation bubbles, inflation, war, credit cycles, oil prices, manias & panics: the tipping point that triggers each bear market is always different. However, bearish forces ultimately manifest themselves in just two ways; declining earnings and/or declining valuations. June’s Of Special Interest report detailed how the current bear market has been fueled entirely by collapsing valuations, with the largest P/E compressions occurring in companies with the highest starting valuations.

Research Preview: The Impact Of Falling Estimates

The 2022 bear market has been driven entirely by a collapse in P/E ratios. Last month, we noted that the other potential driver of market declines—falling earnings—had yet to raise its ugly head. Now we examine past episodes to consider how the stock market might react when the “other shoe” (EPS) drops.

Not The Leader We Wanted??

If many of the typical leaders of a new bull market aren’t leading, what is? Technology, obviously—and the bigger, the better.

Here’s One Reason Sentiment Is So Subdued...

Market bulls remain mystified by the lack of enthusiasm for stocks given the proximity of U.S. indexes to all-time highs. They view this relative indifference as a contrarian positive—the “wall of worry” argument.

Can Equity Investors Eat Their Cake And Have It Too?

Investor sentiment seems to be unusually conflicted these days. There are worries aplenty, including numerous political skirmishes of consequence around the world, a slowing global economy, and lofty U.S. equity valuations. On the other hand, fiscal stimulus is high for this stage in an economic cycle and the Fed is easing monetary policy, two policy drivers it rarely pays to bet against.

Leuthold Quick Takes: Getting Sentimental

This issue of Leuthold Quick Takes reviews the conflicted nature of investor sentiment as seen by Doug Ramsey (Chief Investment Officer) and Jim Paulsen (Chief Investment Strategist).

The Yin And Yang Of Utilities

Are Utilities defensives, or are they interest rate plays, or both? We believe the driving influence fluctuates based on market conditions, specifically fear, and the desire for protection in down markets.

Defensive Equity Styles: The Sultan Of Swat And The Splendid Splinter

After performing amazingly well in the record-setting bull market run since 2009, defensive equities are once again drawing attention for their traditional role as hedges against a continuation of recent market declines.

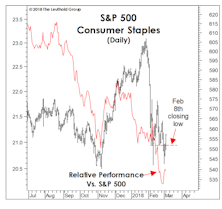

What’s Ailing Consumer Staples?

For the first time in this bull market, defensive stocks failed to provide any semblance of defense during a market correction.

The Many Faces Of Mo

Momentum is one of the most widely accepted alpha-generating factors, used by quantitative and fundamental managers alike. Its biggest drawback, however, is high turnover. Herein we explore momentum from the perspective of sector weights.

A Harbor In The Tempest

Our Major Trend Index (MTI) recently fell from “positive” toward stocks to a “neutral” reading, leading us to trim bullish equity positions in our tactical portfolios.

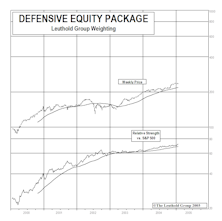

Defensive Positioning With Leuthold’s Groups

With the Major Trend Index now in “neutral” territory, and several well-known market strategists urging increased caution and risk awareness, we offer our perspective on defensive investing from the standpoint of our group work.

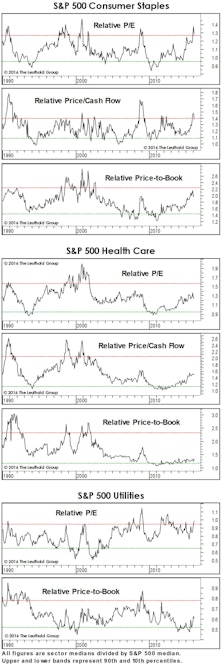

Is Defense Overpriced?

Relative valuations of Staples and Utilities sectors already reflect a “flight to quality” effect. Investors looking to add some economic/stock market defense should focus on the cheaper Health Care groups.

Where’s The Profit Leverage?

Industrial commodity prices and the latest ISM figures both point to a stabilization in the manufacturing sector following a two-year deceleration. Expectations for this year’s earnings have turned more optimistic as a result, but are the hopes warranted?

The EM "Trap"

2015 Leadership: An Early Take

Last year’s economically defensive winners held their grip on stock market leadership in January. This action is consistent with our view that the bull market is an aged, overvalued one that has begun a final “distribution” process that will eventually erupt into a cyclical bear.

Sector Margin Trends

The S&P 500 record median profit margin of 10.3% is now almost a full percentage point above the last cycle’s peak of 9.4% (second quarter of 2007). Trends across S&P sectors are not as uniform as one might expect, though, with only half of the ten sectors last quarter at profitability levels that exceeded their 2001-2007 expansion highs.

The Surprising Winners In Emerging Markets

While we expect an eventual break in this relationship, today Emerging Market equities are following, fairly tightly, the cycle of industrial commodities—a cycle that rolled over (on a secular basis, we believe) in 2011.

Sectors: Where To Hide?

Much like the blue-chip indexes themselves, the cap-weighted S&P 500 sector indexes generally resisted the market mayhem erupting beneath the surface in September.

Defensive And Commodity Groups Improve

Two Consumer Staples groups upgraded to Attractive this month, Beverages and Tobacco. The Energy sector saw Integrated Oil & Gas upgraded to Attractive.

The Bull Market Turns Five

The post-2009 stock market upswing now qualifies as only the sixth cyclical bull market since 1900 to last five years or more. But only three of the previous five-year-old bulls lived to see a sixth birthday.

Leadership: More Of The Same?

Market valuations and investor sentiment are a bit too inflated for our comfort, but the catalyst of the MTI’s drop to Neutral status two weeks ago was simply the action of the stock market itself. Specifically, we haven’t liked the disjointed nature of U.S. market action since about mid-March, where high-yielding and economically-defensive stocks have done the heavy lifting in the Dow and S&P 500 moves to all-time highs. This isn’t so much a change in leadership as an acceleration of an existing trend, and it’s now pronounced enough to weigh down a few of our technical measures.

Nothing But Clear Blue Skies Ahead? We're Not So Sure

With no obvious technical resistance left for the U.S. stock market, we’re skeptical of the “long cycle” view, primarily based on valuations and “provincial” data points.

A Look At Thematic And Sector Valuations

Health Care and Consumer Staples valuations don’t look as dangerous as widely assumed. Utilities look expensive; conversely, the big corrections in the Industrials and Materials sectors have yet to create truly compelling valuations. The best sector for contrarians is Energy.

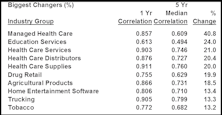

Record Performance Correlations Continue

Industry groups and stocks continue to set records with performance correlations. Defensive groups have seen the largest percentage gain to current correlations relative to the last five years. There truly has been no place to hide in this market.

Now Entering Increasing Risk Aversion Environment

Risk Aversion Index accelerated in May, making it prudent to favor defensive assets near term. Expect small and gradual increase in long term interest rates.

Expect Foreign Stocks to Continue to Outperform U.S. Stocks in this Bull Market

Superior performance of foreign stocks of late is likely only the preamble to what the rest of the cyclical bull market will look like.

Back To A Less Aggressive Equity Exposure

The “Fail-Safe” was triggered by the poor market action at the end of February, and we are moving towards a 50% net equity exposure. Caution seems prudent despite the Major Trend Index remaining in positive territory.

Time For Some Defense? - Attractive AND Defensive Groups To Consider

Following the market rout of recent weeks, we imagine there are many clients sharing our nervous view of the stock market. For those clients, especially those managing long-only equity strategies, we thought it may be helpful to highlight some defensive groups that are scoring well in our group work.

May's Market Action

“Sell in May, then go away” goes that old piece of Wall Street wisdom. Problem is, this year everybody seemed to sell in May, so going away doesn’t seem like such a good idea anymore.

Defensive Equity Groups...Some Time-Tested Ideas, And A Few New Ones

In our most recent update of our defensive group work, we examined industry group performance within the last four bear market cycles in order to determine which groups delivered consistent leadership.

Will Traditional Defensive Groups Work The Same This Time Around?

For clients unable to shift to equity alternatives or increase cash holdings, this month’s “Inside The Stock Market” section provides an update of our Defensive Stock group study in order to identify some potential hiding places.

View From The North Country

Steve Leuthold’s commentary on how he would structure a defensive portfolio.

Looking For Some Defense?

A look at which equity groups have historically held up best during market declines. We revived our “Defensive Equity Group” theme, with individual stocks selected from each of these individual defensive groups.

Building A Defensive Equity Portfolio

Many professional portfolio managers are “equity only” managers, precluded from building up large cash reserves or considering alternative asset classes. Ideas for those who must be fully invested.

August Was Terrible

August’s decline was the largest monthly decline since October 1987. Recommended Client Strategy: maintain most defensive equity stance available - if cash is not an option, concentrate in defensive equity sectors.

Defensive Equity Sectors

For those who are looking to reduce their downside risk, we present potential Defensive Equity Sector Ideas, including Electric Utilities, REITs, Phones, Natural Gas and Value stocks.

Defensive Sectors: A Performance Check

A performance check on defensives for the last two months.

Major Trend Index Even More Negative

Major Trend Index turned "negative" March 8 and has continued to deteriorate.

Looking For Defensive Stock Groups?

Many professional portfolio managers are "equity only" managers, precluded from building up large cash reserves or investing in equity alternatives. This section should be of special interest to readers that fit this profile.

.jpg?fit=fillmax&w=222&bg=FFFFFF)