Health Care

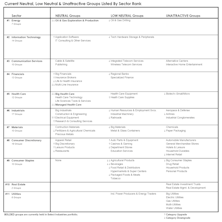

Weight Watcher Update—Still Like Value Sectors

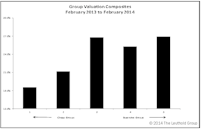

While the valuation gap between Growth and Value sectors was compelling just a couple of years ago, it has closed drastically the last twelve months. Our analysis shows that Value sectors (Energy, Industrials) are still more favorable than Growth sectors (IT, Health Care).

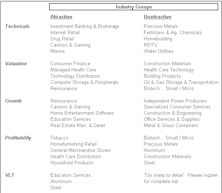

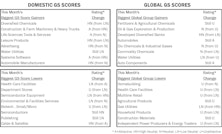

Rate-Sensitive Groups Dominate Unattractive List

Utilities, Real Estate, and Consumer Staples are the bottom three sectors among the GS Scores.

Additional Factors

The S&P 500 had an almost biblical upheaval to start 2023. The “last were first” and the “first were last.” In January, the 100 worst performing stocks of 2022 had an average return of +16.1% while last year’s 100 best performers posted +1.7%.

Additional Factors

The six-week rally that started mid-June featured advances from AAPL (+25%), AMZN (+30%), and TSLA (+39%), which accounted for one-fourth of the S&P 500’s gain. Despite the recent preference for Value, a spike in interest rates, and the bear market, the index’s concentration in the top-five firms is still near it’s all-time high set in August 2020.

“Reliable” Health Care And The Presidential Election

Health Care has been resilient this year, but will that continue in the run-up to the presidential election? We look at the performance of the Attractively-ranked industry groups and how they have historically performed leading up to an election and post-election.

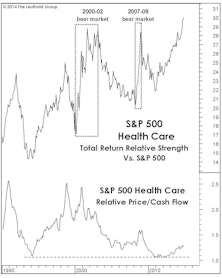

Robust Health Care Leads Since Market Peak

Health Care has been the best performing sector following mid-February’s market peak. Its robust relative performance during this bear market isn’t terribly surprising given the sector’s defensive qualities, but it has impressively outpaced other safe haven areas.

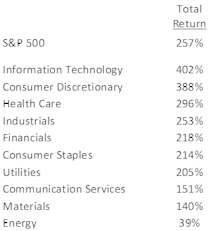

Industry Returns: The Decade’s Winners & Losers

This “decade in review” edition examines the performance of sectors and industries, looking at the best and worst groups to reveal the stories they have to tell.

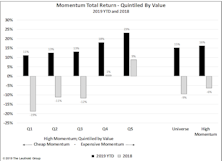

Factor Performance: Has Anything Changed In 2019?

· From a factor performance standpoint, 2019 is looking a lot like 2018, with expensive Momentum names outperforming everything else and Value struggling.

Sector Rankings

The top-three rated sectors are Health Care, Communication Services, and Consumer Discretionary. Scoring lowest in the latest rankings are Energy, Materials, and Financials.

Sector Rankings

The top-three rated sectors are Communication Services, Health Care, and Consumer Discretionary. Scoring lowest with the latest ratings were Materials, Energy, and Industrials.

Sector Rankings

The top-three rated sectors are Health Care, Communication Services, and Consumer Discretionary, with Information Technology dropping from the top-three. Rounding out the bottom end of the rankings, for the second consecutive month, are Materials, Energy, and Consumer Staples.

Sector Rankings

For the sixth consecutive month, the top-three rated sectors are Health Care, Consumer Discretionary, and Info Tech. Rounding out the bottom end of the rankings are Materials, Energy, and Consumer Staples.

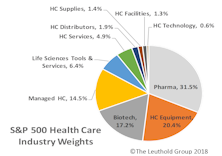

Defensive Health Care Outpaces The Market

Recently, Health Care stocks have been making headlines as the sector rallies to new all-time highs. However, when we look at the sector via Leuthold’s proprietarily-built industry group composition—which has a more realistic market-cap weighting approach—the Health Care sector has been outperforming since the end of 2017, and YTD it is the #1 performing sector in our work.

Sector Rankings

Following a seven-month stint as the highest-rated sector overall, Consumer Discretionary relinquished the throne to Health Care.

Do Health Care Stocks & Elections Mix?

A look at Health Care groups’ historical performance both pre-election and post-election; we identify past trends of leaders and laggards in each period.

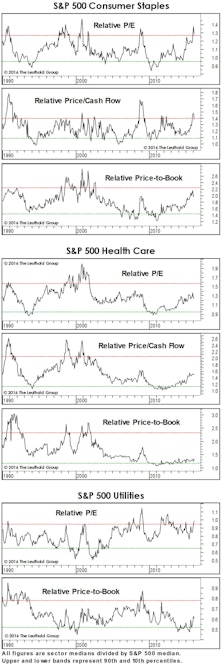

Is Defense Overpriced?

Relative valuations of Staples and Utilities sectors already reflect a “flight to quality” effect. Investors looking to add some economic/stock market defense should focus on the cheaper Health Care groups.

Info Tech, Financials, Health Care—Remain Top Three Rated Sectors

Among the bottom ranked sectors are Utilities, Materials, Energy, and Telecom Services. These four sectors have been the bottom four rated sectors for a minimum of eight months.

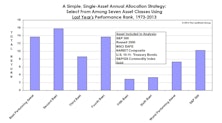

Bridesmaid Sector Strategy

Our original research on price momentum dates back to the late 1960s, and was based not on asset classes but on equity sectors and industry groups. We stumbled upon the Bridesmaid effect, in fact, while testing a handful of simple strategies about a decade ago.

Health Care Comes Down With A (Minor) Cold

A reversal in momentum, driven by the oil and commodity stocks’ rebound, caused investors to take gains from Health Care positions. We’re still big fans of Health Care and think recent weakness is more of a correction within a sector bull market than the start of a full-fledged bear.

GS Score Sector Rankings, and Highlighted Attractive Groups

Health Care, Consumer Discretionary, and Financials are the top three rated broad sectors.

Health Care & Consumer Sector Strength Explored

While we view the industry group selection as the most important decision, looking at the sector level rankings also helps us identify broad trends. Here we highlight the top two rated sectors, currently, which also represent a combined >40% weight in our Select Industries Portfolio.

Gruber The Guru?

Last month’s tactless comments from MIT health care economist Jonathan Gruber contained an (accidental) investment nugget we’ve alluded to several times in the last three years (and, no, it does not relate to the “stupidity of the American voter” or investor).

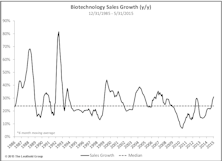

Biotechnology Now Attractive; Purchased In Select Industries

This group offers low correlation, some defensive qualities, and a dose of volatility. Health Care is now the top rated broad sector and we are overweight this sector in Select Industries Portfolio.

A Clean Bill For Health Care Facilities - Group Purchased In August

U.S. demographic and economic trends coupled with meaningful expansion of the insured population should continue to support Health Care Facilities.

Late March Reversal… And The First Shall Be Last

We examine the impact of March’s strong group leadership reversal on the top and bottom of our group model.

Profit Margins At The Sector Level

All ten of the S&P 500 sectors recorded a sequential increase in four-quarter trailing net profit margins. But consider where sector margins stand today relative to their 25-year medians. Eight of ten S&P 500 sectors are recording profit margins well above their long-term medians.

Health Care Strength... More Than Biotech?

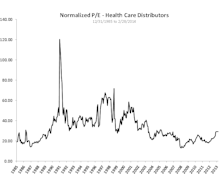

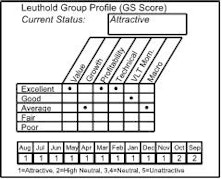

Three groups currently rank Attractive in the GS Scores: Health Care Distributors, Managed Health Care, and Health Care Equipment.

GS Scores in 2014

Looking forward, groups from the Information Technology, Health Care, Consumer Discretionary, and Financials sectors look appealing.

Buy The Bridesmaid, Not The One Looking To Rebound

The investment leadership of a given year has historically had better-than-even odds of outperforming in the following year at both the asset class and equity sector levels.

Stock Market Leadership In 2014: Large Caps, Tech, Health Care

Following a great year for trend-following, capitalizing on key reversals in sector performance will be important in winning the 2014 performance derby.

All Indices Down, 32 Groups Up In Latest Week

| Best Performing Industry Groups | |||

|---|---|---|---|

| Industry Group | 1 Wk Perf |

4 Wk Perf |

YTD Perf |

| Broadcasting | 2.3% | 0.3% | 55.8% |

| Drug Retail | 1.9% | 1.3% | 80.2% |

| Trading Companies & Distributors | 1.7% | 0.7% | 30.1% |

| Casinos & Gaming | 1.7% | 3.8% | 65.3% |

The Stealthy Move In Health Care

Among the few things untouched by the Obamacare rollout are the rising relative strength patterns of most health care stocks.

A Checkup On Managed Health Care

Despite continued question marks surrounding the effects of Health Care Reform, sentiment seems to have shifted for the better, and a number of broad industry drivers are trending in a promising direction. This group currently has three categories rating Excellent in our domestic group model.

Group Models: Info Tech Tops Domestic, Financials Tops Global

Both models (particularly domestic) have a number of Attractive rated Information Technology groups and no Unattractive rated Tech groups. Financials’ domination of the Global Attractive range continues.

Sector Margins: Just Thank The Consumer

We’ve noted before that profit margin gains since the technology boom have been primarily a Large Cap phenomenon.

Health Care Distributors Purchased In Select Industries

Excellent scores in three of six model categories, plus it offers plenty of market cap and low beta relative to other Health Care groups. We think it will benefit from broad, long-term industry trends.

Group Models Agree On Energy & Materials

But Information Technology rises to the top of the Domestic model, while the trend of Financials domination in the Global model remains intact.

Domestic and Global Group Models: Strong Agreement On Financials

Our Domestic Scores have five Financials groups rating Attractive; these same five industry groups are Attractive in our Global model. In total, seven Financials groups rank Attractive in the Global model, with insurance groups looking particularly Attractive.

Leadership: More Of The Same?

Market valuations and investor sentiment are a bit too inflated for our comfort, but the catalyst of the MTI’s drop to Neutral status two weeks ago was simply the action of the stock market itself. Specifically, we haven’t liked the disjointed nature of U.S. market action since about mid-March, where high-yielding and economically-defensive stocks have done the heavy lifting in the Dow and S&P 500 moves to all-time highs. This isn’t so much a change in leadership as an acceleration of an existing trend, and it’s now pronounced enough to weigh down a few of our technical measures.

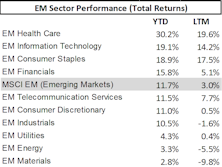

Mapping The Emerging Market Health Care Sector

We’ve published a series of research notes detailing our thoughts on the Health Care sector in Emerging Asia and formed a thematic group “Asia Healthy Tigers.” Even though most of the investable companies in Emerging Market Health Care are located in Asia, we decided to expand to other regions as well.