Leading Economic Indicators

Groupthink?

Question: While hopes for an economic soft landing have ticked up a bit, the consensus view among economists still seems to be for a recession in 2024. Does having so much company concern you?

Response: Of course!

The LEI Clock Is Ticking

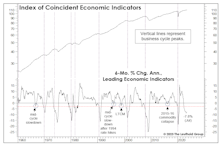

A contraction of 3% or more in the LEI’s six-month annualized rate-of-change has always been associated with a recession, with an average lead time of four months. Using that guideline, the most recent recession warning was triggered in June 2022, and the lead time is now approaching the longest ever recorded (16 months in 2006-07). If today’s lead time matches the 2006-07 experience, the business-cycle peak will occur in October.

Be Contrary On Discretionary

The Fed’s June announcement of a pause with further rate hikes to come has extended the uncertainty of whether an inverted curve and persistent policy tightening will ultimately lead to a recession. The business cycle is a critical investment issue because the relative returns of many assets depend on the state of the macro economy. This study examines the Consumer Discretionary (CD) sector’s behavior in recessionary times, with the goal of understanding the typical performance pattern during economic lows in order to help investors position their portfolios for a potential recession.

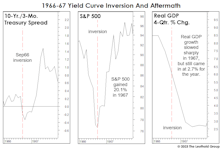

Revisiting The 1966 Forecast Failure

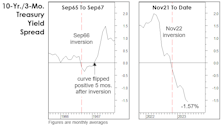

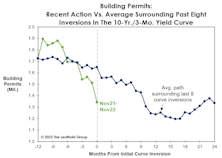

Developments over the last four months leave us even more skeptical that the November yield-curve inversion will join 1966 as a “false positive.” The number one reason being the subsequent shift in the yield curve itself.

1966-67: When The Yield Curve “Failed”

Given the tendency of economists and strategists to dismiss the message of an inverted yield curve, it’s surprising there’s been no scrutiny of the “dog that didn’t bark”—the inversion of 1966. That’s the last time an inverted curve did not lead to a recession.

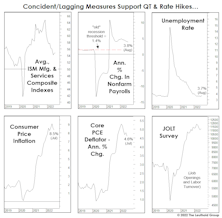

The Economy Rallied In January, Too

The narrative for January’s strong stock market bounce is that not all key economic releases looked to be forecasting a recession. However, one must consider that this was only true for coincident and lagging data series.

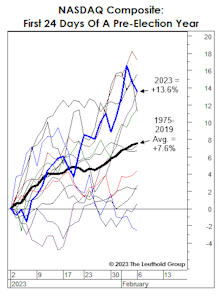

Irrationality Is Back, Right On Schedule

The hostile monetary backdrop makes recent stock market exuberance even more irrational than in early 2021. Yet, this is the middle of a seasonal window that historically boasts an elevated level of craziness: It is the year preceding a presidential election—a time when monetary and fiscal stimulus are ramped up.

The Yield Curve And The Problem Of Timing

Frequently, there’s money to be made in the stock market in the months following the initial curve inversion. After the inversions of August 2006 and June 2019, the S&P 500 rallied another 23% and 19%, respectively, into its final bull market high. If this cycle plays out in textbook fashion, the business-cycle peak would arrive in September.

Not If, But When

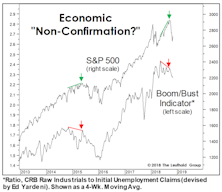

Economists who believe a 2023 recession will be avoided, may not know it but they are “messing with perfection.” Since August, we’ve chronicled several developments that have, without fail, correctly forecasted past recessions, or confirmed that one was already underway.

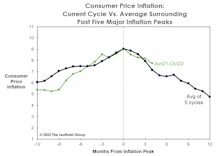

Goodbye Inflation, Hello Recession?

Unlike the five prior cycle peaks, this year’s inflation peak materialized during an ongoing economic expansion. That implies the “post-peak” monetary policy has never been tighter than today—making a soft landing even more improbable.

A Trade Contrarians Will Love

Time cycles have been spot on in 2022, with the stock market declining through the mid-year months (May-October) of a mid-term election year. But November 1st saw the opening of the market’s most bullish window according to the same patterns.

Tightening Into A Slowdown: Month Eight

We think the U.S. economy will slip into recession sometime in the next year, but the level of “excess savings” provided by pandemic aid renders the already difficult task of timing more elusive than ever.

Tightening Into A Slowdown: Month Seven

An economy can slow to a standstill on a “real” basis while growing rapidly in nominal terms; it happens in emerging economies all the time. But this dichotomous condition now afflicts most of the developed world.

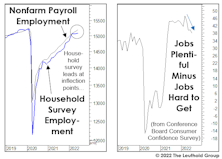

Job Market Suddenly “Laboring”

We cringe when we hear the Treasury Secretary or a regional Fed bank president dismiss the possibility of recession on the basis of “low unemployment and strong job gains.” Those measures are as “laggy” as any economic statistics the government publishes.

LEI On The Precipice

The LEI’s 3.6% six-month annualized loss through September 2006 was the largest decline not followed almost immediately by a recession. This year, the LEI contracted by 3.7% over the six months through June—if a recession is avoided in the current experience, it would be the most misleading signal in the history of the LEI as currently constructed.

Monetary Madness

We always do our own work and draw our own conclusions. Lately, though, we’ve wondered what the late “Monetary Marty” Zweig might say about the stock market’s current liquidity backdrop.

Is A Strengthening Dollar A Form Of Policy Tightening?

Executive summary (for those leaving early for the holiday weekend): No.

We’ve found no reliable relationship between swings in the U.S. Dollar and subsequent variations in U.S. economic growth.

Slowdown Or Recession? Confidence Is Key

The pattern of sharp sell-offs followed by equally sharp rallies continued in June. Most risky assets recouped nearly all the losses suffered in May, and then some.

About That Great Jobs Report...

The December employment report temporarily eased fears of a severe U.S. slowdown. That’s a mystery to us.

Too Soon To Expect Economic Weakness?

We believe stocks have begun to discount a major inflection point in the economy and corporate profits for 2019 and 2020.

Cashing In On The LEI?

The consensus view is that the stock market will be fine as long as there’s no recession in sight.The same LEI that has displayed a fine GDP forecasting record has shown essentially no relationship with S&P 500 forward twelve-month performance. In fact the regression line shows a slight negative slope!

Market Pressure Points?

Last month we detailed a handful of economic and monetary measures that were approaching critical thresholds from a stock market perspective.

Better To Have And Not Need

"Need To Have” confirming indexes were nearly all perfectly aligned with the latest market high, and a second set of indexes we consider less critical, but “Nice To Have,” has also been in virtual lockstep.

Keep An Eye On The LEI – Leading Indicators Have Topped, But Have Yet To Roll Over

The Index of Leading Economic Indicators has a proven track record of indicating when a recession may be near. Although this index has been trending sideways for quite some time, it has not yet rolled over.

Keep In Front Of The Economic Curve

Stock market is a leading economic indicator, and typically turns down before the economy turns down. On average, 40% of the stock market decline occurs before the recession begins.

A Bumpy Road To Recovery

Market begins to shake off “Enronitis” and as economic positives continue, the next rally could come quickly. And yes, it was a recession.

Market Timing With The Index Of Leading Economic Indicators

Index of Leading Economic Indicators, a good coincident indicator for the stock market. Looks like it’s on the mend.

View From the North Country

Stock market still considered lead economic indicator? Maybe not, considering the last three years, the stock market has been driven by Main Street. Changing role of portfolio managers: risk management function reduced to minimum if it even exists at all.

The Stock Market and the Economy: Lead and Lag Relationships

In past issues, we have postulated that the next major stock market decline would not precede an economic downturn as it typically has in the past. Rather, the relationship would be coincidental, with the stock market and the economy turning down at about the same time.

.jpg?fit=fillmax&w=222&bg=FFFFFF)