Treasury Yield Curve

Premature Aging?

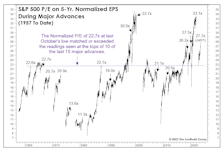

If today’s stock market is indeed a new bull, its vital signs advise that it is more in need of a coffin than a cradle. Monetary policies, both in terms of rate hikes and the inverted curve, have never been more hostile at this stage of a major stock market upswing.

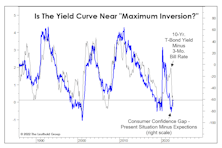

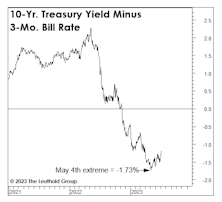

Maximum Inversion?

Factoring in both the duration and depth of the existing yield-curve inversion, it is considered more severe than all predecessors since the 1960s. Even Duke University yield-curve guru, Campbell Harvey, abandoned his January forecast that a recession would be avoided.

This Curve Threw Us A Curve...

Future economists learning of zero interest rates and Fed balance-sheet expansion during the 2021 inflation surge may wonder if policymakers were “on” something. Jay Powell is clearly “onto” something with his focus on a measure that few are familiar with: the Near-Term Forward Spread (NTFS).

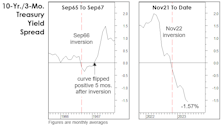

Revisiting The 1966 Forecast Failure

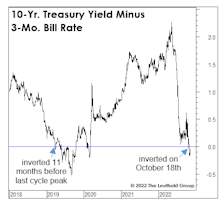

Developments over the last four months leave us even more skeptical that the November yield-curve inversion will join 1966 as a “false positive.” The number one reason being the subsequent shift in the yield curve itself.

Checking In On The Rally At The Six-Month Point

Yesterday was the six-month anniversary of the bear market low of 3,577.03 in the S&P 500. We think it’s unlikely the moderate upswing since then represents a new cyclical bull market. However, with the evidence still weighing in at Neutral, we’re not betting the farm on that opinion.

Small Caps: We’ve Seen This Setup B-Four

In mid-2020, we wrote that a new multi-year leadership cycle had probably begun. Technically, that belief hasn’t been disproven, but the extent of outperformance has been disappointing in the nearly three years since.

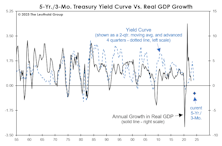

The Yield Curve Meets Microsoft Excel

To our surprise, the measure that most closely correlated with real-GDP growth on a one-year time horizon is the rarely mentioned Treasury spread for the 5-Yr./3-Mo.

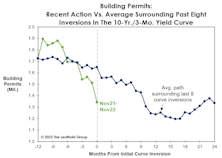

The Yield Curve And The Problem Of Timing

Frequently, there’s money to be made in the stock market in the months following the initial curve inversion. After the inversions of August 2006 and June 2019, the S&P 500 rallied another 23% and 19%, respectively, into its final bull market high. If this cycle plays out in textbook fashion, the business-cycle peak would arrive in September.

The Inversion Before The Inversion

We found the spread between the “Expectations” and “Present Situation” series (the “Confidence Gap”) has historically moved almost in lockstep with the yield curve. As the Confidence Gap plummeted throughout 2021, the implication was the yield curve would soon follow. After some initial resistance, it did.

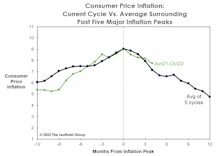

Goodbye Inflation, Hello Recession?

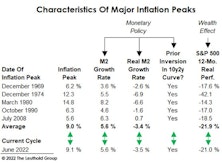

Unlike the five prior cycle peaks, this year’s inflation peak materialized during an ongoing economic expansion. That implies the “post-peak” monetary policy has never been tighter than today—making a soft landing even more improbable.

How This Year’s Inflation Peak Differs From Its Predecessors

Our studies of economic and stock market history are meant to provide perspective, not an investment roadmap. But occasionally a current trend will resemble the past so closely it’s eerie.

Take the current inflation cycle. If (as we believe) June’s CPI inflation rate of 9.1% represents the peak for this business cycle, then many of its characteristics have lined up almost perfectly with the “average” of past inflationary episodes.

Which Yield Curve?

Last month’s inversion in the 10-Yr./3-Mo. Treasury spread further tilts an already lopsided scale in favor of a U.S. recession in 2023. That spread has been considered the gold standard from an economic forecasting perspective, and is the basis for the New York Fed’s Recession Probability estimate (which, by the way, should break above its critical 35% threshold when it’s published later this month.)

More Signs Of Peak Inflation

As suggested in our June 24th, Chart of the Week, the peak in consumer inflation (+8.6% in May) has likely either occurred or is imminent. Consumers should thank the stock market, which in 2022 has taken up its occasional role as inflation-fighter after the Fed abdicated throughout 2021.

.jpg?fit=fillmax&w=222&bg=FFFFFF)